If we’d been told just a few years ago that the industry would be rocked by a global pandemic, our expectation would have been for complete panic across the industry. What we saw instead, just one year ago this week, was only a brief and justifiable period of volatility, followed by swift and agile adaptation to the new environment. As is the nature of human beings, we saw our teams, clients and collaborators shake off the shock to forge ahead and find new ways to approach our new normal.

The response to the pandemic has also helped to accelerate evolutions in software and technology with a focus on making remote environments more efficient. From “Zoom Diligence” to “work from anywhere” flexibility, the industry was able to adapt to and even find opportunity in the constraints on travel and in-person collaboration.

Here, we share a few views from the Vidrio team of the year that has passed, and predictions for what lies ahead. We hope you’ll find the following reflections to be insightful, and as always, we welcome your comments.

Antonio Simonini, Managing Director, Client Services:

Antonio Simonini, Managing Director, Client Services:

“At Vidrio, we are a small, but agile business that caters to very large organizations. As such, we already had a strong business continuity plan (BCP), which we had tested and regularly refined in the years prior to the pandemic. As a result, we were able to instantly shift in March 2020 to a 100% remote working capacity with no impact to the services we provide. And while I would have expected better preparedness in the ability of bigger players to shift to remote work, we did initially see that some large businesses lacked the necessary infrastructure and had to rush to set up the required equipment and connectivity, while also updating relevant policies. That said, it was comforting to see that those same organizations were able to make quick decisions, cut the red tape and adapt quickly to new technologies. Processes that normally would have taken years to adopt were quickly and efficiently pushed through, proving that when necessary the financial industry can adapt rapidly.

Looking ahead, businesses must keep in mind that changes that have occurred and may continue to occur at the organizational structure will not be temporary, and there is more to consider than just remote working. Companies must shift to a faster, better, more agile operating model to remain relevant and avoid being rapidly surpassed by those capable of reacting more quickly.”

Willett Bird, Director, Business Development:

Willett Bird, Director, Business Development:

“Over the summer, once companies and individuals had settled into the new routine of working remotely, I was surprised at how many folks were predicting ghost towns and the end of offices in major metropolises. It turns out that the odd story about how a large asset management company might be relocating from the Big Apple to sunny Florida does not necessarily mark for a larger trend. It will undoubtedly take months if not years, but global financial centers will eventually regain their footing. Office life will be different, and “Work from Home” will no longer be the ugly duckling, but I think Financial Services will revert back closer to what it was in 2019 than what it is today.”

Mazen Jabban, CEO:

Mazen Jabban, CEO:

“As we've learned over the last year, adaptability continues to be tested and changes will need to come so that organizations can take control of new opportunities and avoid being bogged down by endless data and technology challenges. Institutional Investors are facing new challenges and must find new options to combat ongoing market volatility, fee pressure and diversification of investments to alternative assets.

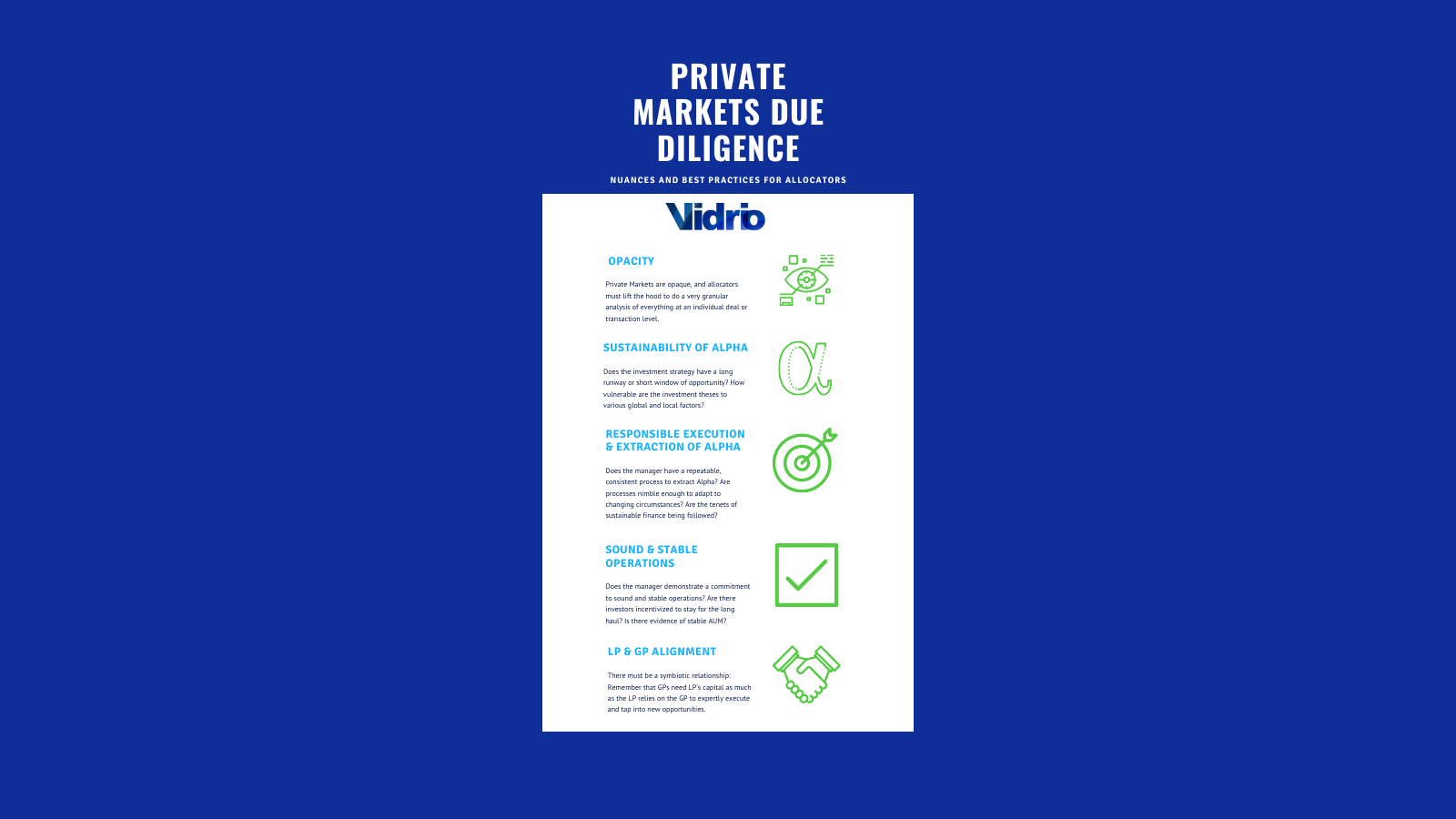

As highlighted during our most recent Coffee and a Conversation, allocators and LPs are seeking more multi-dimensional investment opportunities across alternative assets, pushing boundaries, and seeking more idiosyncratic returns within the Private Markets. This commingling of public and private investments will pose a challenge to allocators who don’t have a single lens through which they can look holistically across their portfolio, regardless of asset class or number of external managers. Vidrio has been preparing for this moment and are now enhancing our Vidrio Solutions with broader, deeper multi asset class portfolio valuations.”

The Vidrio Vision

As we continue to shift into new ways of working and servicing our clients, it is in the ongoing spirit of the past year’s agility and adaptability that we will continue to ensure our clients have what they need to facilitate collaboration and control across their investments and business. Our vision of ongoing adaptability, enhancements and tailored services remain at the core of our mission to our clients and the broader industry.