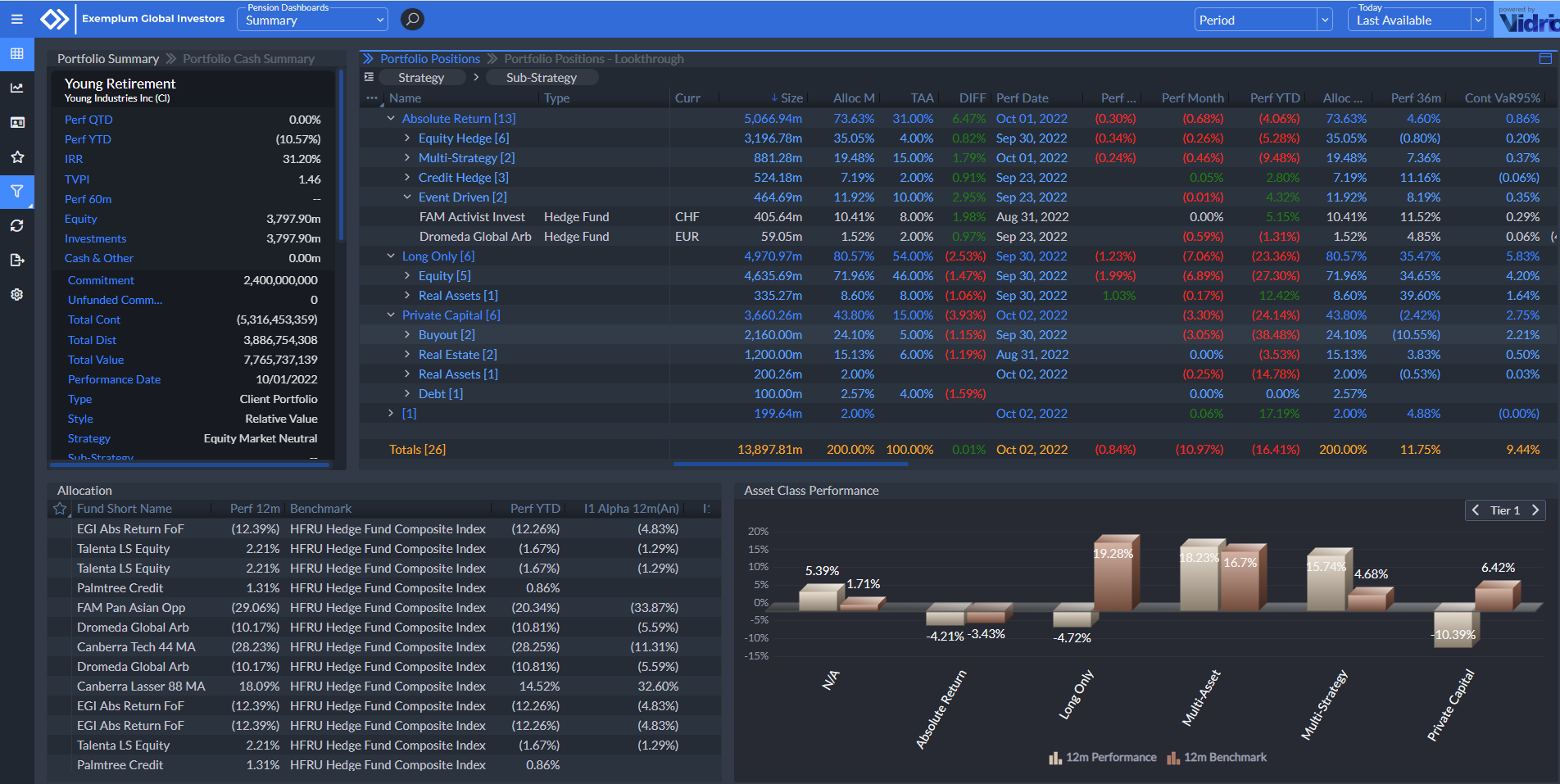

As more millionaires are made each year, family offices are feeling the pressure to grow wealth, improve their infrastructure and receive greater transparency across their investment strategies. Family office clients are spread across the globe, leading many of their firms to deal with increased regulation, risk and exposure, compliance, reporting, and overall valuation.

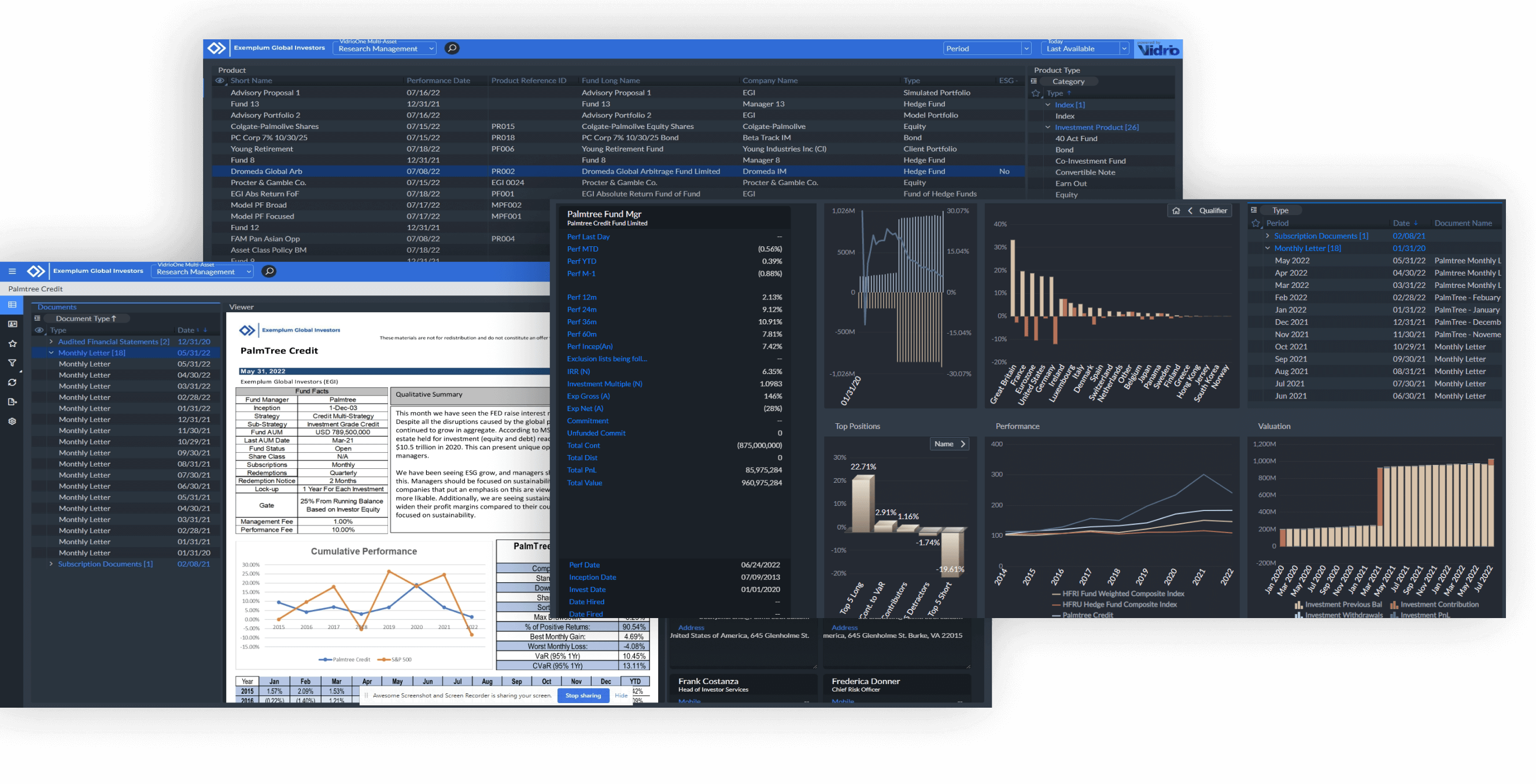

Vidrio’s technology-enabled service (TES) platform can help your family office streamline reporting functions in real time. With Vidrio, you have a single platform for global portfolio monitoring, risk, research management, advanced-level compliance controls, tracking ESG investments, improving the transparency of fund terms to your family office clients, and much more.

.png)