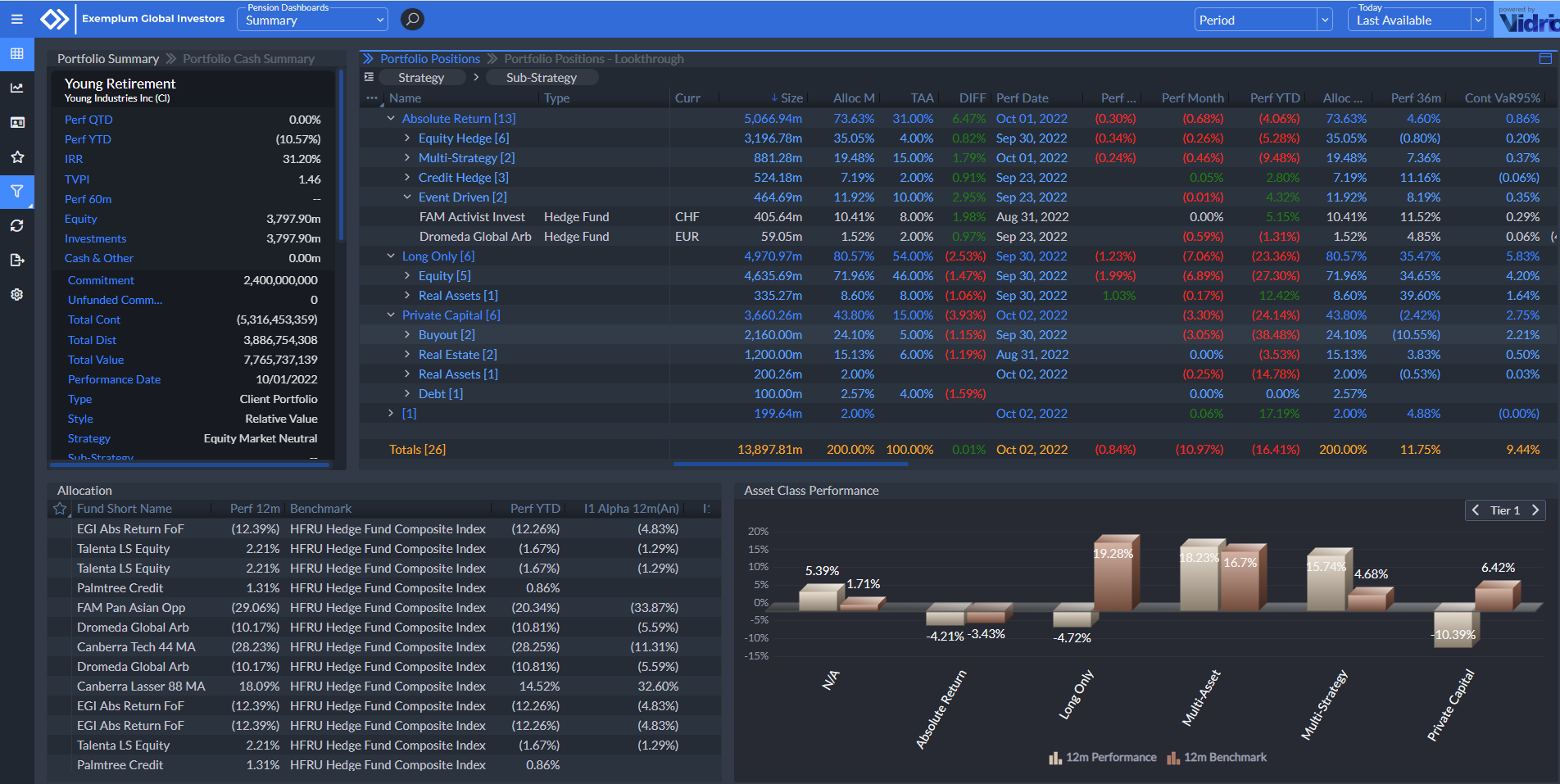

A Canadian pension plan dealing in private markets and liquid alternatives had grown and required a more efficient view of its portfolio. Currently, they leveraged multiple vendors for different areas of expertise. This led to a platform that spread out their quantitative and qualitative data points, risk, and other documents, leading to higher costs and declining collaboration. Data collection was also a nightmare and suffered from various delays. Vidrio came in and worked with their investment team to craft a truly consolidated platform, reducing costs, improving transparency, reporting, and investment controls. With Vidrio at their side, they avoided an alternative of building out a custom allocation platform.

.png)