Vidrio's CEO, Mazen Jabban joined a virtual panel of fellow industry leaders for the October 9th Talking Hedge Webinar: Managing Risk and Improving Alpha with Customization. The panel was part of the Talking Hedge Santa Monica event series, Customization is Key: Delivering Bespoke Solutions to Institutional Investors. In this post, Mazen summarizes key takeaways from the discussion and his own observations of how Vidrio’s clients are responding to the various trends discussed during the panel.

Investment Risk Management Calibration During the Pandemic

The panel kicked off with a discussion about the current pandemic and how we’ve seen the industry adapt, particularly with regard to risk management:

- Impact on holdings: Our clients have been focusing more frequently (than pre-pandemic) on what they own, as well as depth of information within their holdings, e.g., exposure, liquidity, and leverage. For example, “How is each holding performing? What can I do about poor performance? Can I get out of specific positions or change my allocation?

- Increased virtual contact with fund managers and investors alike:

- Asset managers are under increased demand from their investors for more frequent and informed conversations, and in turn they require more frequent and meaningful conversations with their external managers – far more than the usual due diligence - to understand how the ongoing volatility is impacting their allocations.

- There is a constant cycle of virtual meetings, phone calls and email communications to discuss insights on risks and opportunities, and then communicate that information clearly to internal and external stakeholders.

- Organizations that have successfully pivoted to a virtual environment in the early days of the pandemic are better able to assist their investors and more easily conduct remote due diligence.

- More emphasis placed on the importance of agile systems and processes: important from both the manager and investor’s perspective that solid, future-proofed infrastructures be in place for whatever the “new normal” might be.

Virtual Due Diligence – Here to Stay?

Another key topic of discussion was how allocators and fund managers can best adapt their due diligence processes to a virtual environment while onsite, in-person meetings are not possible.

We’ve always recommended that allocators try to do as much research, analysis and preparation before any onsite due diligence visit to ensure onsite time is optimized. Vidrio has always enabled this idea, so in our clients’ case, the impact on due diligence has been less of an issue. The industry of course had some initial hurdles and learning curves to overcome before fully embracing the idea of Zoom Diligence, but we’ve seen the industry get past that quickly to realize the benefits of pivoting from onsite to virtual visits.

- More efficient: While there is certainly great value to kicking the tires on-site and making eye contact in-person, the trade-off is more efficient use of time and resources. Consider the amount of planning and organization that must go into site visits - from travel and hotel plans - to trying to pack multiple managers into one trip org – and compare that to the fluidity of remote meetings.

- Less costly and less disruptive: In-person due diligence meetings often require multiple team members traveling to multiple locations, a costly proposition in terms of both T&E and valuable resources being away from the office. With remote due diligence processes, travel is obviously no longer a concern, but it also means that more members of the team can participate in more meaningful ways without disrupting day to day business operations. In other words, both allocators and fund managers can have all the right people available at the right time, without necessarily having to dedicate an entire day(s) away from business as usual.

- Agile Systems: We’ve seen our clients transition smoothly to remote processes in part due to the agility and resiliency of their Vidrio workflows. Our clients’ teams are still able to remotely access the same source of multi-asset class data, information, and analytics to effectively manage due diligence and research, as well as portfolio construction, risk management, trading, and compliance processes.

Allocations Moving from Public to Private Markets

The question of risk management in public vs. private markets was raised, and broadly speaking, the panel agreed that there is less of a discrepancy between the two, with most allocators looking holistically across markets in determining risk and identifying opportunities.

Vidrio’s own clients are managing both public and private managers, and we have certainly seen the barrier between the two decrease in more recent years:

- Where it used to be “either, or,” we now see allocators looking holistically at liquidity and opportunities across the public and private markets, and then deciding where and how to allocate across different vehicles: hedge funds, co-investments, risk premia, private equity, private credit, etc.

- We have also seen a lot of hedge fund managers move into private investments, and conversely, there is also a history of investments into private managers that became public.

- This commingling poses a challenge to allocators who don’t have a single lens through which they can look holistically across their portfolio, regardless of asset class to see their exposure and also to be able to match liquidity for the purpose of funding new investments. This is why Vidrio continues to evolve our own software and managed services, expanding beyond hedge fund allocation to also support the unique nuances of private asset class allocations.

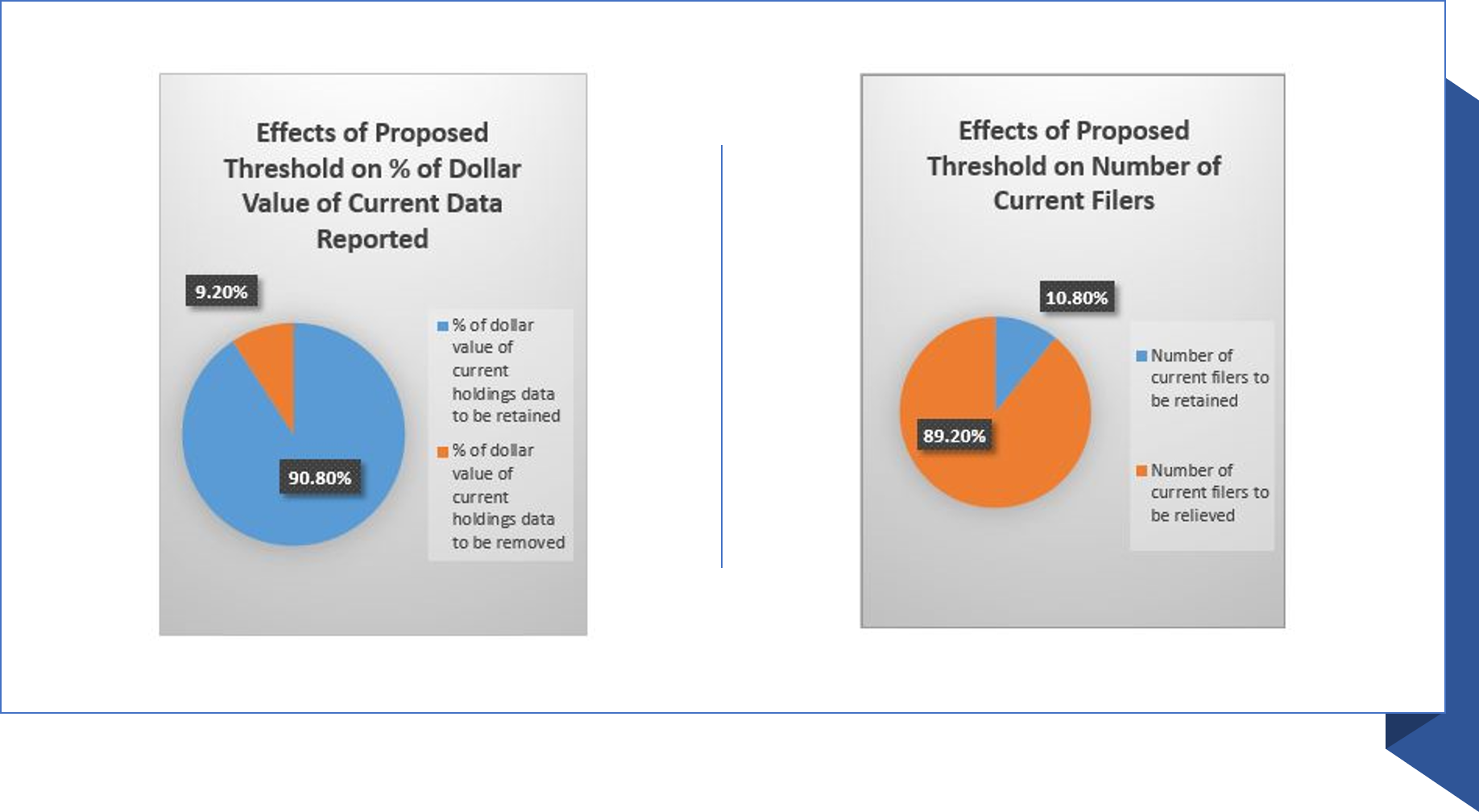

SEC’s proposal to raise the threshold for 13F Filings

In July, the SEC announced the Proposed Rule on Reporting Threshold for Institutional Investment Managers, which proposes an amendment to raise the threshold for reporting specified equity securities on Form 13F from $100 million to $3.5 billion. With the discussion back in the headlines over the last week due to the publication of comment letters, our panel weighed in:

- The panel agreed that the potential increase in the threshold is certainly not good for transparency and debated whether the potential change might bring opportunities for hedge fund managers to generate better returns. It was suggested that perhaps quant funds and those that are more market neutral could benefit, as they could rely on just aggregated ownership data, but long/short funds would not find benefits.

- Beyond the question of threshold raising, institutional investors – particularly those who allocate to external managers - should be questioning the actual benefits of the so-called transparency offered by 13F filings:

- 13F data is stale data

- With the proliferation of co-investments, multiple investment strategies and customized products, you don’t actually get very much from a 13F disclosure, which is only going to be at a Management company level, vs. providing transparency at the individual fund level.

- At Vidrio, we are big proponents of transparency. We believe allocators deserve and should have transparency and control across all their managers, and we also believe in safeguarding the managers’ sensitive positions within a given portfolio. We can provide both: independently sourced information on holdings/exposures across all their managers, while also protecting the sensitive names that managers want to keep secure.

Fee Management: Customization is Not for Everyone

The panel wrapped up with a discussion about fee management, and the question of customization came up as a beneficial way to creatively manage fees. For example, performance fees can be spread over a particular horizon vs. just annually. The panel agreed that while customization can be very good for the right investor, it’s not for everyone. For instance, challenges can arise if a manager must suddenly handle multiple mandates and does not have the right infrastructure or bandwidth to effectively do so. They are likely to see lower performance through customization when tasked with multiple mandates.

I'd be happy to speak with you about any of the above discussion points, and I encourage you to view the Talking Hedge events page for a list of additional webinars planned through the end of November.

As you prepare for the year ahead and the unknowns of tomorrow, consider a consultation with Vidrio. We can help you to evaluate your current systems and processes, while also helping you to assess budgets and total cost of ownership.

Related Thought Leadership from Vidrio:

- 13F Disclosures, a More Nuanced View

- Ready for the “New Normal?”

- Allocators Face New Obstacles in Pandemic While Redeeming from Funds

- Holistic Portfolio Management in Times of Market Stress