We are full steam ahead on the release of Vidrio 7 (V7) and are pleased to announce that the updated Investor Portal, the first release native to V7, is now fully live and available to all existing Investor Portal users.

Current Portal users are encouraged to request access and training for the new release if you’ve not done so already. If your organization does not currently use the Vidrio Investor Portal, please contact info@vidrio.com to request a demo.

We are excited to continue work on additional applications native to V7, including the new Transaction Editor and Trading System. We look forward to providing further updates to you in our next newsletter. If you have any questions regarding the V7 project, please do not hesitate to contact us.

Finally, please be reminded that we have enhanced our multi asset class functionality to include the integration of our Private Capital Markets capabilities. The new capabilities also include availability of the Eureka Private Equity data directly via the Vidrio platform. Existing clients can contact support@vidrio.com to discuss. If you are not a Vidrio client, but would like to learn more, please contact info@vidrio.com.

In This Issue

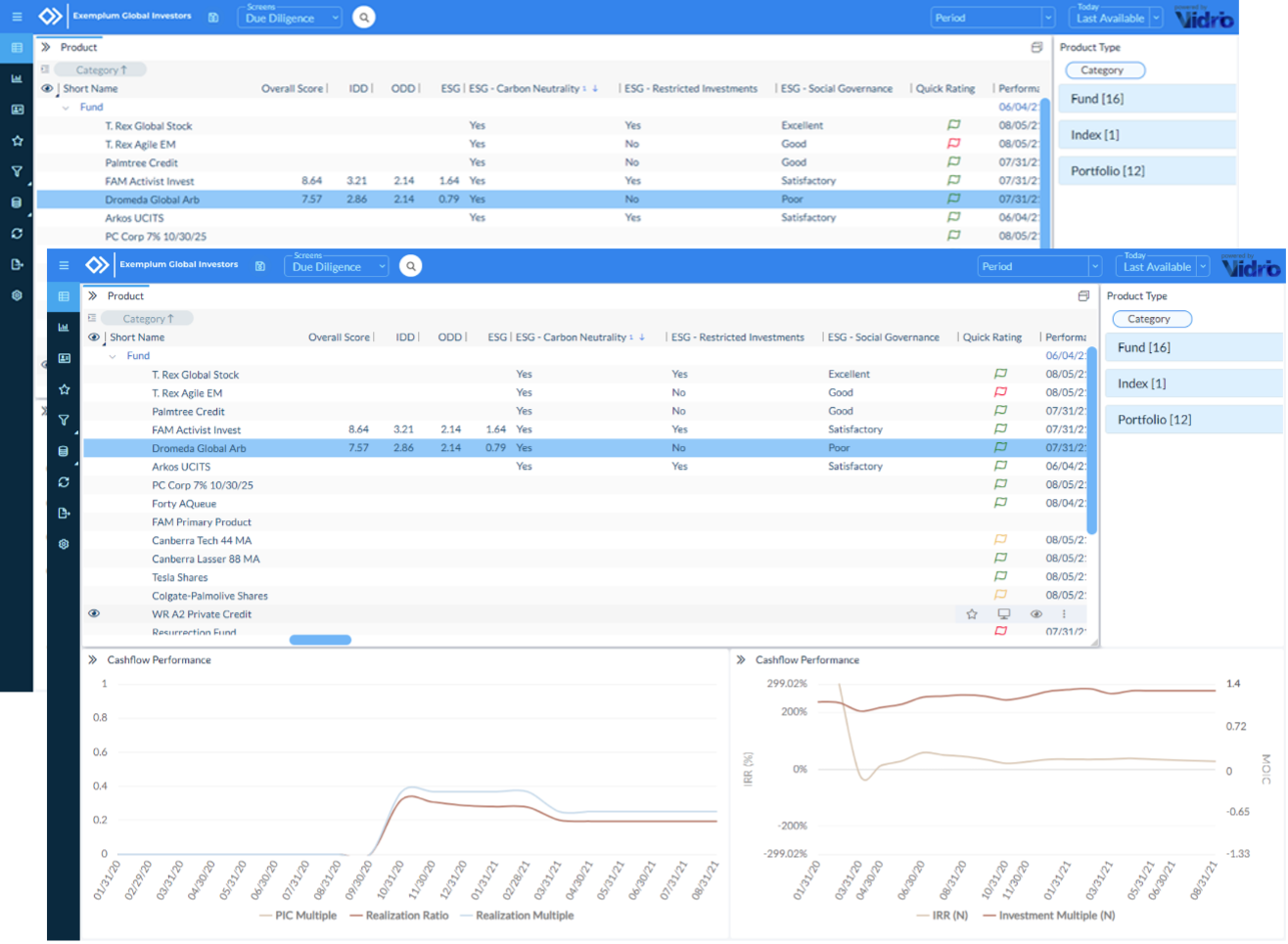

- Support for ESG Manager Scoring/Reporting

- Enhanced Account Level Performance and Statistics

Q2 Vidrio Insights – Our Latest Industry Research, Blog Posts and Media Coverage

Featured Releases

Support for ESG Manager Scoring/Reporting

ESG investments are growing exponentially, and while regulatory frameworks are starting to take shape, a global set of ESG standards for measuring and reporting on sustainable finance remain in flux. While we cannot speak to exactly how and when those standards will take shape, we can certainly speak to best practices for collecting, measuring and interpreting data, and we are currently accelerating ESG projects for Vidrio clients. As we continue to gain valuable insight into how our clients are measuring and interpreting ESG factors, we are in a strong position to support your individual scoring needs.

Account Level Performance & Statistics

We have added performance and statistics for the actual realized share class performance that Vidrio clients see in addition to flagship statistics.

Existing clients can contact support@vidrio.com to discuss any of the above capabilities. If you are not a Vidrio client, but would like to learn more, please contact info@vidrio.com.

Introducing Vidrio Views

Vidrio Views is a series of monthly market surveys and corresponding reports that analyze the sentiment of leading institutional allocators and LPs in relation to the industry’s most pressing topics of the day. View our most recent reports for July and August, and to register to receive our monthly surveys and results.

Q2 Vidrio Insights

|

Alternatives Watch Investor Compendium 2021 Who were the world’s largest institutional investors that placed some $103 billion across more than 600 investment mandates last year?

Special Offer on Behalf of Vidrio and Alternatives Watch: |

|

Vidrio Financial Adds Eureka Private Equity Database Eureka Private Equity provides access to information on 9,160 companies and private equity funds, investors, private equity firms and service providers across the private market’s spectrum. The database gives investors up-to-date returns data on private equity and venture capital funds, along with information on the people managing them. Read more about our partnership with EurekaHedge. |

As always, we hope you find value in this update - whether currently considering options to solve your organization's alternatives allocation challenges or simply interested in best practices from across the industry. Please contact info@vidrio.com to learn more.