Enhancements of the Vidrio platform allow for true multi-asset class portfolio management

New York, N.Y. – November 28, 2021 – Vidrio Financial, a provider of managed data services and software for institutional alternative allocators globally, today announced significant updates to its services and platform that further transform the future of asset allocation and support the unique needs of institutional investors who allocate to external alternative asset funds, including hedge fund and private equity managers.

“As we continue to build on our long-term vision to become the de facto solution for institutional allocators, over the last 12 months we have made a series of updates to the Vidrio offering. These enhancements enable our clients to better manage their complex alternative investments and external manager relationships through deeper insights and analytics, collaborative workflows, and more streamlined stakeholder reporting,” said Mazen Jabban, Chief Executive, Vidrio Financial.

Vidrio Financial’s enterprise client base is comprised of large global institutional investors including leading pension funds, asset managers, investment banks, insurance companies and funds of funds who allocate a significant portion of their investments to external fund managers. The firm provides insights across the alternative investment universe, including hedge fund, private equity, private credit, real estate and liquid alts.

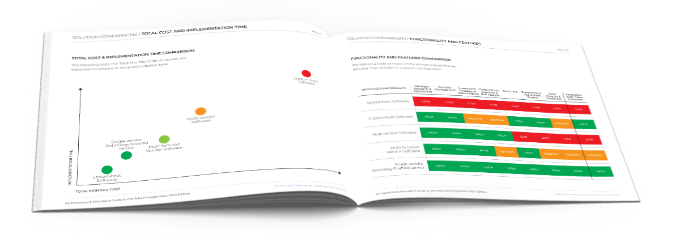

Designed to transform the future of asset allocation, these enhancements include more flexible portfolio and manager monitoring service bundles, a more intuitive interface, evolved multi-asset class integration of Vidrio’s hedge fund and private capital markets capabilities, advanced analytics, and ongoing technology innovations.

These developments complement Vidrio’s existing services and tools and include broader, deeper multi asset class portfolio valuations, improved data visualization, more sophisticated and customizable charting capabilities, browser agnostic, cross-platform compatibilities, more robust multi asset class analytics and more accessible service bundles powered by enhanced machine learning innovations.

Vidrio has also seen notable growth in client acquisition and retention rates during the year-on-year period while it has continued to add in new ways to access its software and data services through the rollout of “Vidrio One” earlier in 2021. Vidrio One is the firm’s first non-enterprise offering and was released due to increased demand from a broader range of institutional investors looking to leverage - more economically - Vidrio’s distinct managed data services and proprietary platform technology.

“We were excited to rollout Vidrio One as this represents a more accessible version of our flagship enterprise software and service offering. We have seen notable interest since its debut from endowments, foundations, family offices and other wealth managers that are looking for the core benefits of Vidrio, though doing so with the more simplified functionality, including standardized tools, reduced implementation, and bundled services that comes with Vidrio One,” Jabban added.

Building on its additional funding from Espresso Capital in 2019 to build its commercial efforts and accelerate growth, Vidrio has multiplied its sales and marketing team in 2021 with plans to further build out its team in 2022.

Further aligning with overall institutional demand for private markets that grew to $7.4 trillion in 2020, with private equity accounting for the largest growth of all private asset classes, according to McKinsey, Vidrio also added the Eureka Private Equity database to its enterprise offering in the fall of 2021, as well as expanding its Index services to include Pivotal Path. The Company is also finalizing discussions with leading external ESG database providers as well as other Private Equity data sources. These partnerships expand on the Company’s existing relationships with Qontigo/Axioma for risk, and HFR and Morningstar.

“This addition of the Eureka Private Equity database was in response to increased demand from our institutional investor clients and prospective clients to help them allocate across the alternatives landscape leveraging Vidrio’s all-in-one multi-asset class data services, analytics and applications,” Jabban added.

Born from first-hand experience of allocating to hedge fund managers, since its launch in 2011 Vidrio Financial has worked as an external partner to many of the world’s leading investors who allocate to external managers, across multiple alternative asset classes. Collectively its clients actively manage over $5 trillion in total AUM, of which over $100 billion in alternatives portfolios are managed on the Vidrio platform.

About Vidrio Financial

Vidrio Financial (www.vidrio.com) is the first Technology Enabled Service for allocators — providing managed data services and portfolio management software to institutional investors globally. Vidrio’s multi-asset class data services, analytics and workflow applications empower allocators to take control of their complex investments and external manager relationships while reducing costs, optimizing resources, and mitigating operational risk.

For More Information:

Click the button above or send an email to info@vidrio.com

Media Inquiries:

Craig Allen, Managing Principal

Allen & Associates Communications

P: +1 475 419 4468

craig.allen@aacomms.net