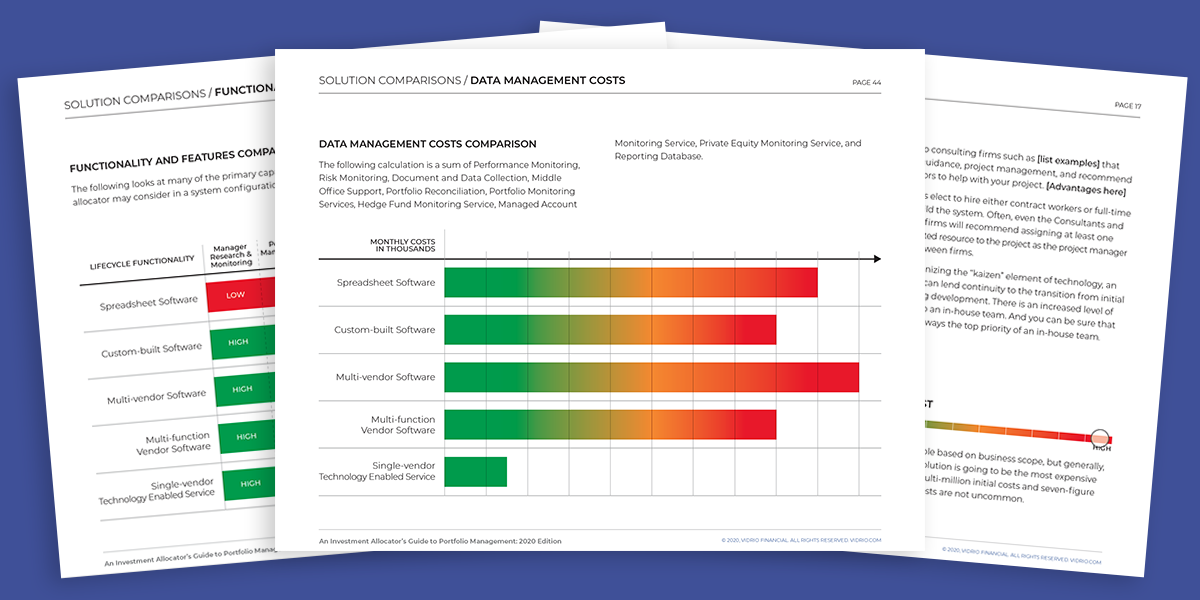

One of the most widely used solutions capable of catering to an array of individual specialties is a combined patchwork of disparate tools and services for each functional need. While this approach seemingly allows allocation firms to leverage each area of expertise, it can be a hindrance to collaboration, accuracy, timeliness, and efficiency. Additionally, the costs can be insurmountable to set up all the necessary integrations and maintain with a growing staff and escalating service fees.

To give you an idea of how complex and costly kludging together a total system can be, here is a sample of vendor solutions an allocator could choose for isolated specific functions:

For firms that have dedicated teams for specific functions, such as research, risk, operations, or compliance, selecting solutions devoted entirely to each might make sense. Function-specific software is, as you would expect, very adept within its confined vertical.

The central theme with the multi-vendor approach is specialized functionality with this comes decentralized data. The costs of the multi-vendor method are sneaky; along with the system licenses, extra staff to manage each specialization and data port integration add to the operational cost. Custom integration tools or the trusty spreadsheet system are necessary to bridge the unconnected systems. The architecture is guaranteed to hinder growth, expansion, and potential upgrades as decentralized data create operational risk and errors between integration points. These weak points create inefficiencies and various risks across the franchise.

The multi-vendor approach creates several data problems.

- There is limited transparency into what teams and tools are doing.

- Systems are operating asynchronously from scattered and separate data pools.

- Equally, there's the limited insight into how out of sync data input may be in informing analytics.

- Reassembling the data product of each system into a unified data pool for reporting and portfolio management is cumbersome.

- Knowledge is at risk of being locked up within a system if the specialist leaves or creates a barrier to collaboration in any way.

The bottom line of what you need to know, the multi-vendor system might benefit institutional investment firms where each functional area has highly specialized idiosyncratic needs and willingness to collaborate across teams consistently. Even then, a lack of transparency, fractured data pools, and increased risk remain. When allocation firms need improved data flow, visibility, and the ability to react quickly, then they should consider a single integrated system. Technology Enabled Service seamlessly combines all the functions of the investment lifecycle with data to lower costs and increase productivity.