Spreadsheet software such as Excel may be the de facto system for financial institution's portfolio management, but should they be? With increasing staff, volumes of data, assets, and client responsibilities, spreadsheets quickly decay. The alignment between tables of information precariously poised on formula integrations and manual updates.

Wheels were once the de facto improvement to transportation, and we still rely upon them every day; everything from planes, trains, and scooters transport people and goods on wheels. The transfer of information, however, occurs at lightning speeds resulting in ever-increasing oceans of data to cull and process before it's rendered historical and outdated. Spreadsheets are basic wheels; how an allocator employs them determines how fast they can respond to incoming data and market analysis. Complex portfolios depend on more wheels and, as a result, more sophisticated management, analysis, and reporting products to deliver transparency.

The greater reality of a spreadsheet system is daunting. Data entry takes time; analysis takes time; all are delaying actionable insights. Manager views may not even be in sync. Hindered further are client transparency and response. The entire system can breakdown as a result of formula error, the omission of data, or input failure. Even on its best days, the spreadsheet paradigm fails to provide a holistic view of multi-asset class portfolios.

Undoubtedly, asset allocators make better investment decisions when equipped with robust data and analytics. When bogged down with data entry and information integration, the entire system becomes impacted. Sophisticated investors want a unified line of sight of performance and risk across asset classes. Spreadsheets limit the allocator's ability to act on data in real-time and answer client questions with information rather than saying, "I'll check on that."

While there are trillions of dollars from family finances to state pension systems managed on spreadsheets, spreadsheets have inherent limitations, particularly in the fast-paced data age we live in. There are far better alternatives to consider enabling asset allocators to make better investment decisions.

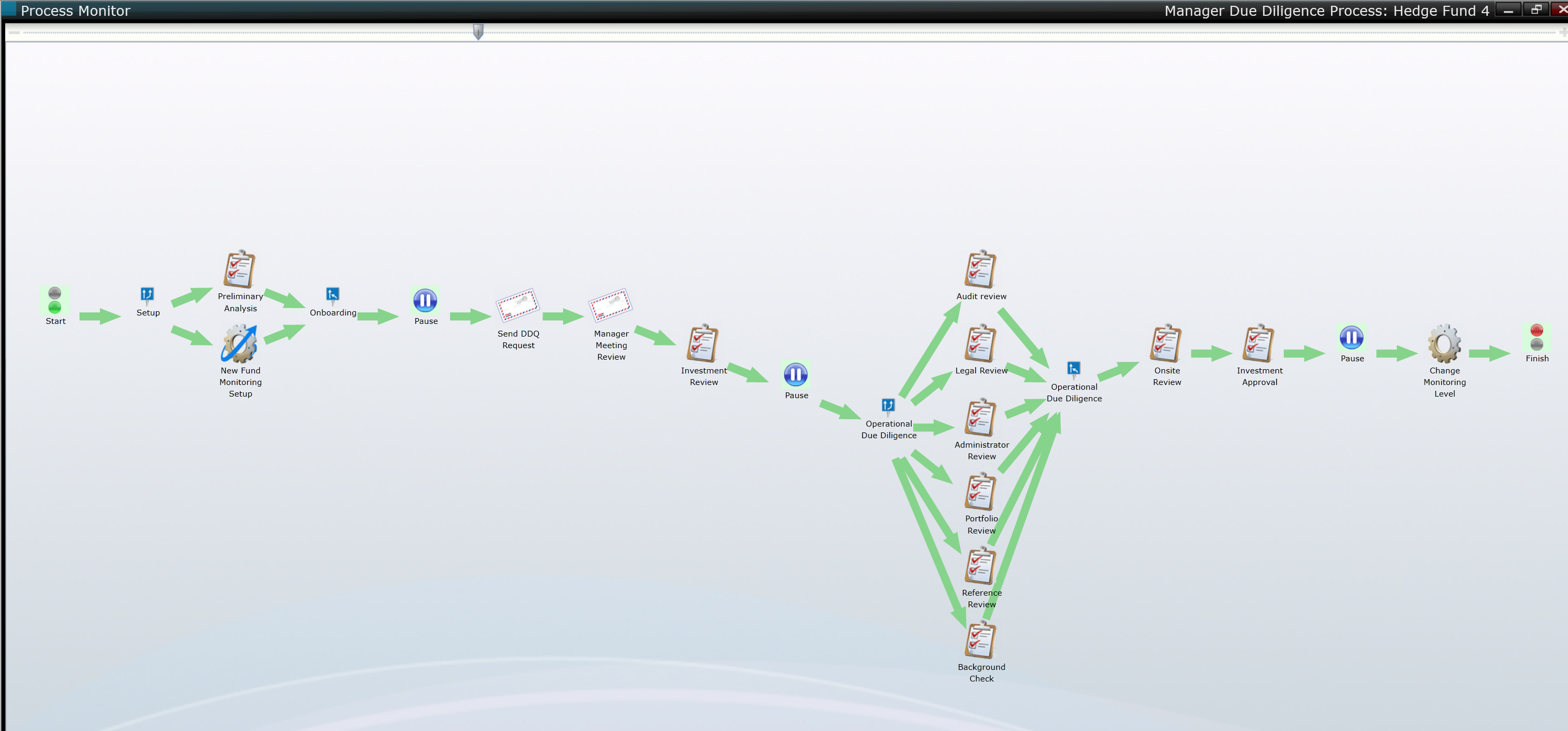

For the problems today's portfolio managers face, the variety of operational solutions range from basic spreadsheets to full-service software and data platforms. Vidrio Financial is a Technology Enabled Solutions company offering multi-asset class portfolio management––a single vendor providing analytics and reporting tools paired with data services.

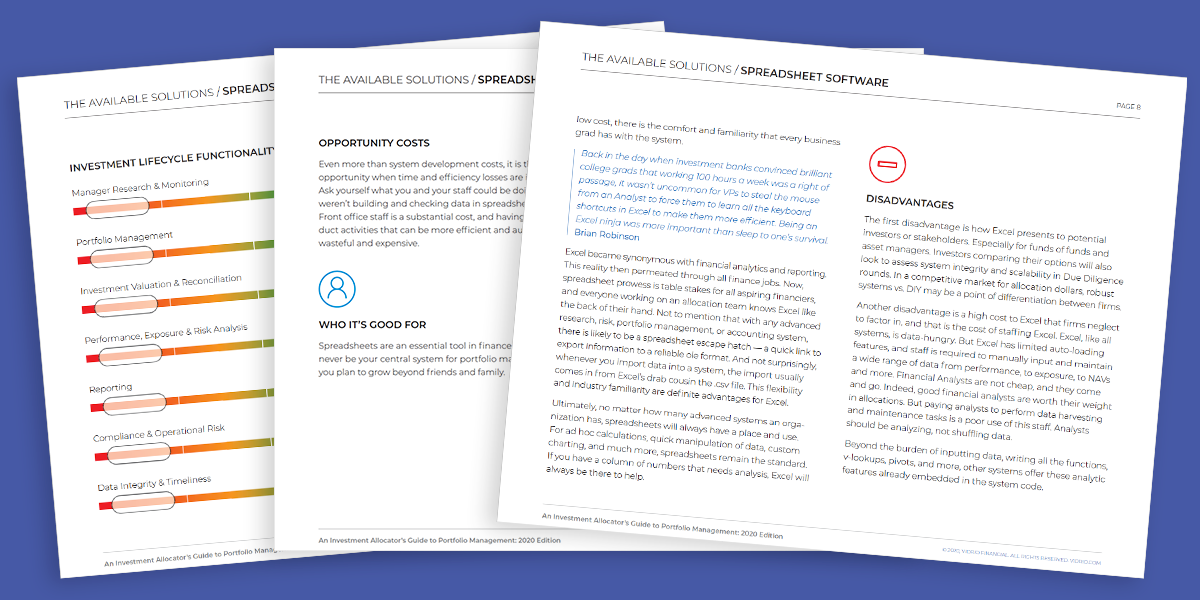

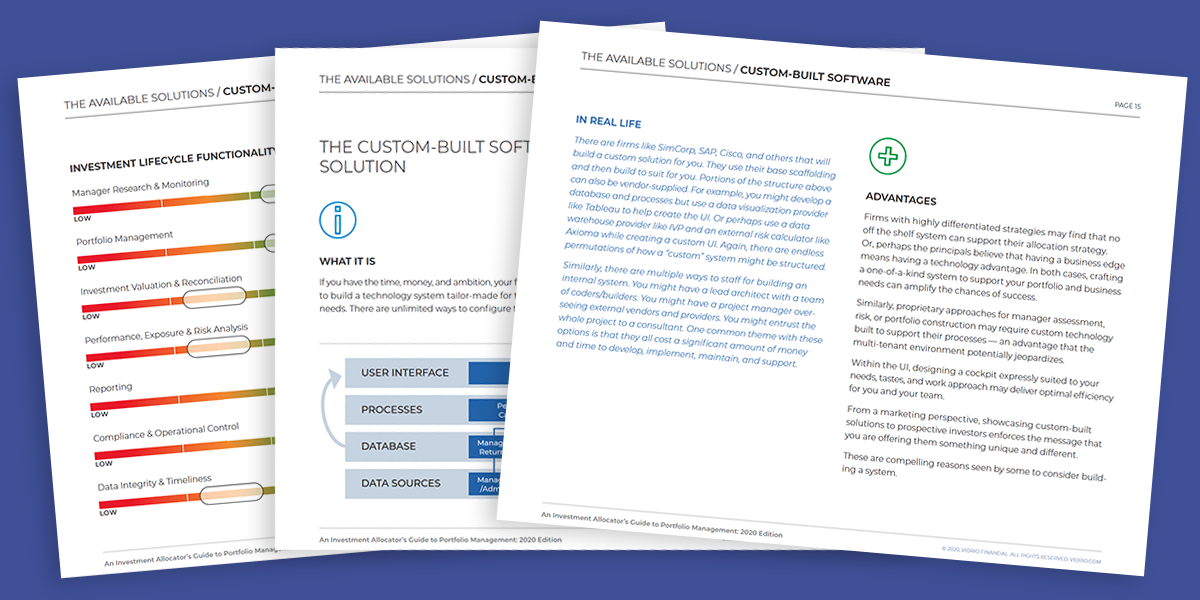

Discover the range of software and vendor solutions that exist in An Investment Allocator's Guide to Portfolio Management Solutions | 2020 Edition. The resource offers an in-depth analysis of the options to consider when spreadsheet systems start to hinder fund management. Discover the Advantages and Disadvantages, understand the variation in Implementation Time, and what Expected Costs are associated with each.