Did you get to attend the BAI Alternative Event last month? Vidrio Financial did, and came away with great insights around portfolio data transparency, private equity strategies, artificial intelligence and more.

By: Hattan Jabban, Business Development Executive, Vidrio Financial

At the end of April, Vidrio Financial had the opportunity to attend the BAI Alternative Investor Conference, in Frankfurt, Germany. This event provided an important view of how alternative investments are playing their parts in institutional portfolios and how investors are weighing risk mitigation versus higher returns. Let’s review our takeaways from this event.

The GP vs. LP Challenge on Risk and Performance:

The first presentation was by Oliver Freigang, CEO, Co-Founder, qashqade AG. The discussion centered around the challenges of transparency. From Oliver's view, transparency, not only in this market, but in the relationships between GPs and LPs is challenging. Many LPs don’t have much say in how the data is relayed, and when it does get to their investment teams, statement details are severely lacking. GPs typically have one expert that deals with the performance, risk, and other calculations of their investments. This can lead to significant errors in Excel reports, (60% or more being reported), leaving many GPs to wonder if there is an easier way to make things more systematic and remove errors from the process.

Many LPs that Oliver has spoken with agreed, and were supportive of the fact that there should be a way to get GPs to have a larger stake in the game. Some of those same LPs suggested that a committee could address these concerns before any relationship takes flight.

Here at Vidrio, we recently published a blog from the findings at a London event, where GPs converted data from Excel to PDF, only to have LPs convert that same data back to Excel. You can read more about that here, all Vidrio asks of both GPs and LPs, is to please stop the madness, as there is an easier way to sort through the chaos.

The Private Equity Perspective:

Vidrio hears a lot on different perspectives regarding Private Equity, so our next stop was joining the Private Equity Myths, Assumptions and Expectations to Build Resilient Portfolios, with insight from Mark Hoeing, President, CF Private Equity and Dr. Miriam Schmitter, Head of ex-U.S. Private Equity, CF Private Equity. Once again, the theme of ‘tricky data’ and several myths about Private Equity bubbled to the top of this discussion. Private Equity is an alternative investment class that invests in or acquires private companies not listed on a public exchange. The myths mentioned during this segment included:

- Diversification in Private Equity benefits investment portfolios at the institutional level.

- These Private Equity portfolios remove the noise of the public markets so they’re less volatile.

- Private Equity tends to outperform public investments.

These myths led many in the audience to question where alpha could be found for investors in private equity today. Panelists agreed that caution was necessary and appropriate due diligence should be performed as returns are starting to trend downward, but there are still opportunities across the market.

At the regional level, the U.S., Canada, China, Middle East were good targets for continued PE investment according to panelists. However, in Vidrio’s opinion, outside this event, we have seen slower growth and regional uncertainties being reported when looking at PE investment across China and the Asia-Pacific region in general. Still, opportunities can be found regarding manager types and industry targets. Most agreed that targeted and specialist managers tend to outperform generalists, while healthcare, financial, and information technology are attractive sectors for investment. Information technology is extremely appealing to allocators and their future investments, as Vidrio receives daily inquiries around our own AI and machine learning methodology, as these allocators search for enhancements in their own technology stack. You can read more about our approach in securing data and providing additional AI transparency in our recent blog on the subject. Overall, the mood of the market, and the approach to future private equity investments could be classified as warm to neutral. Entry points should be analyzed for timing by allocators, and transparency into those investments should be prioritized by each investor. The denominator effect is making life harder, as institutional investor portfolios may be overallocated to private markets due to the declines in public investments given increased inflation and volatility.

Our next panel was a focus on Inflation, rising interest rates and recession scenarios: impact on illiquid alternative portfolio, which featured speakers: Dr. Markus Geiger (Head of Private Debt at ODDO BHF), Christoph Manser (Head of Infrastructure International at Swiss Life Asset Management), Sebastian Venc (Head of Private Debt at Muzinich & Co.), Michael Busack (Managing Partner at Absolute Research), Roman Smirnow (Head of Continental Europe Portfolio at Partners Group). This panel had a very similar theme to the Private Equity Myths where a strong trend is evolving for institutional investors in moving from liquid to private investments. Targets of focus for the panelists centered around real estate, infrastructure and private debt, however it was noted that challenges exist in these investments. They stressed that diversification is still key, and no single asset should account for more than 5% of your portfolio in today’s market. Real Estate was agreed to be underweight but being selective is key for your targets. Office buildings investments are being sidelined now in hopes that volatility falls a bit and distressed opportunities present themselves leading to better returns.

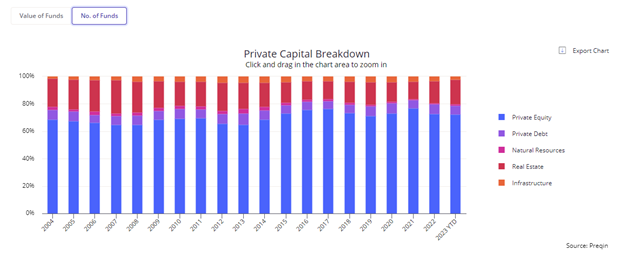

According to a recent article in Wealthmanagement.com deals are still occurring when it comes to real estate but tends to involve pensions, sovereign wealth funds and insurance companies. Panelists commented that when it comes to real estate investments, location, people movements, building quality, and tenant needs, all factor into the investment rationale. In terms of private debt, over the last 12 months funding used to cost around 7%, investors have now seen rates closer to 11% which of course eats into their returns. Still, panelists agreed that private debt is here to stay and provides a critical source for institutional investors that are focused on innovation for improved returns. We at Vidrio expect to see an increase from investors that are focused on IT, Healthcare, and Business Services as these tend to be stable sectors with the most opportunities for the future. According to the chart below from Preqin, you can see that Private Debt remains relatively unchanged vs. 2022 numbers, where Real Estate has a slight increase of ~2% for 2023.

What’s an event without ESG and AI?

Does anyone else feel like we have reached a point with AI and ESG that’s like your favorite weekend movie? You want to look away and do something else, but you know that it’s everywhere, and you just can’t avoid tuning in to the conversation. The ESG: Impact Investing – Opportunity for Private Markets, with Dr. Lukas Adams (Head of Institutional Clients at GLS Bank) & Ralph Kretschmer (Managing Partner at EBG Investment Solutions) and the Artificial Intelligence: the use of machine learning in PE investment with Marco Perfetto (Associate at Unigestion) had some familiar themes that we have heard at other events, and through Vidrio’s own podcast and blog coverage.

On the ESG front:

1. ESG has the ability to provide solid financial returns2. There’s ~$1.164 trillion currently being invested in impact investing and it’s supposed to rise to $90 trillion by 2030.

3. ESG measurement and reporting is still a concern.

In terms of Artificial Intelligence for institutional investors:

1. Any AI discussion should provide investors with full global coverage, be efficient to implement and source deals based on the criteria that is implemented into the machines.

2. The machine + human equation should stimulate conversations about investment topics. Then through that dialogue certain factors might appear that have not been considered in the past as it relates to investments.

3. The dialogue that comes from AI execution should remove all human biases towards a particular investment or manager. However, it shouldn’t replace the human portfolio manager. AI should simply call out red flags that might have been hidden without being utilized in the past.

When it comes to ESG investments, Vidrio agrees that it has the ability to provide solid financial returns, those returns should always be balanced with the fiduciary responsibilities of the portfolio as a whole. Leaning the portfolio into more ESG investments without proper reporting and analysis could lead to diminished returns. You can review our past ESG thoughts here.

On the AI front, Vidrio’s most important rule of thumb or goal is to get to a point where human intervention is needed only when the machine is at a cross-roads and unsure of the next steps. By reaching this level, investment teams can spend the human capital on further investment studies and due diligence into managers and asset classes. Our full artificial intelligence and machine learning perspectives can be read in our updated blog here.

The World Stage for Germany, Europe, and Sweden

It’s no secret that Germany’s economy is attractive to LP’s because of factors that include a low debt-to-GDP ratio and a steady stream of innovation that requires investment capital. In the panel, Germany & Europe on the way to the next financial and debt crisis, Professor Jorg Rocholl, PhD, outlined some missteps on how Germany approaches the investment arena.

Early on, many believed that the Russia/Ukraine war would impact Germany’s investment prospects. That never seemed to transpire, instead many point to a mis-allocation of capital in Germany and the borders across European markets (specifically taxes and labor laws between different countries). Germany also boasts the highest savings rate across Europe, (~40% of income is pushed into savings with 30% going to institutional investors – and there are strict investment regulations on top of that 30%), only second to Sweden. Due to higher than average savings efforts, Germans can’t seem to make the transition from wealth savings to wealth creation, leaving those seeking investment funds to push outside of Germany. However, that transition to wealth creation may be starting to change due to ongoing ESG and climate change debates.

From a recent Preqin blog, transition to technologies that address climate change will help drive investments in Germany and could lead the country to become a major exporter of cleantech products. Furthermore, Preqin’s Company Intelligence dataset shows startups inside Germany, that focus on cleantech, have already attracted $229M worth of investments this year, 2022 investment dollars (for the entire year) totaled $704M. Germany also happens to be the largest source of greenhouse gas production across Europe, something they’re hoping to change by aiming for greenhouse gas neutrality by 2045.

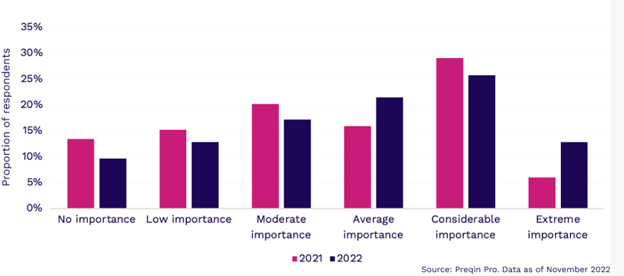

For our time remaining at the BAI Alternative Investor Conference, we wanted to get some further insight into pension funds and alternative investments. In the Investor Speech – Pension Funds in Alternative Investments, speaker Richard Grottheim, CEO of Seventh AP Fund, AP7 – Sweden, led off that a longer term mindset is key for success in pension funds. Richard has seen that risk taking leads to better performance and should vary over time. Admittably, ESG is becoming more and more important with pensions, a fact that was supported earlier this year in Preqin’s research on how ESG importance is factored when making an investment decision:

As for the Nordic market, Richard admitted that investment rules for pensions have become less stringent over the years, especially when compared against the German market from the past conference panel. He did note that diversification is key and needs to be done in several aspects, including:

- Asset Classes

- Taking on a broader world view portfolio

- Evaluation of various risk premiums

- Time diversification – important given the current volatility and the hopes that as investments age, volatility declines along with risk profiles.

- Currency risk

In addition to the diversification approach, he also touched on the debate around the 60/40 portfolio. As Vidrio has written about, we see more of our clients opting for a 50/30/20 split, and Richard tended to agree, that as portfolio complexity grows, pension funds should work towards allocations of 20% when considering alternative investment allocations.

We hope you enjoyed our takeaways from the BAI Alternative Investor Conference, in Frankfurt, Germany. If you would you like to learn more about Vidrio Financial and how we’re leveraging the latest allocator insight into future platform enhancements as it relates to data transparency, ESG scoring, private markets, and portfolio monitoring, then please reach out.