Missed out on attending the World Pension Summit last month? Don't worry, Vidrio Financial is here to provide you with a comprehensive overview of the panel discussions that took place on topics such as sustainable investing, energy transition, pension retirement challenges, and sovereign wealth staffing.

By: Hattan Jabban, Business Development Executive, Vidrio Financial

Last month, Mercer unveiled its most recent Global Pension Index, providing a comprehensive analysis and ranking of nearly 50 retirement systems in the face of an increasingly volatile market. Delving into the study's findings will reveal some pressing challenges, including the continuous rise in the average age of pension participants, the adverse impact of interest and inflation rates on pension systems, and the potential cybersecurity and data privacy risks associated with the growing use of artificial intelligence. To gain a deeper understanding of these challenges, you can explore the study further here.

This study aligns perfectly with my recent attendance at the World Pension Summit in The Hague. In this blog post, I will share my unique perspectives from the event, highlighting specific cases that Vidrio Financial has been closely monitoring regarding the future strategies of pension investment teams.

Regenerating Sustainable Outcomes

To kick off the journey at the World Pension Summit, I decided to listen to the keynote speech from Ronald Wuijster, Chairman of Board, APG Asset Management. Ronald began with a focus on defining and addressing retirement incomes in a more sustainable world. Here at Vidrio Financial, we hear a lot through our Improving Alpha - Innovation in Investing, ESG and Technology podcast, on how allocators are losing the ESG moniker completely. APG echoed these soundbites stating that they are no longer segmenting ESG at a department level or in portfolio management. Instead, they're integrating these investments across their entire decision making process. Portfolio managers increasingly care about responsible investments and look for investments to promote sustainability, while managing returns, costs and risks. Ronald then evolved the discussion into the importance of data and digitization techniques, something that Vidrio is scaling in real time with our clients.

Pensions still must do a better job in communicating intelligence for the community that they serve, especially as sustainable investments get more complex and include themes around energy transition, electrical grids, solar energy expansion, and more. APG is looking at changes coming to the Dutch pension funding system, and the reasons why this is crucial considering some of the conclusions in the Mercer study. Several reasons that resonated to me while listening to Ronald, included:

-

Pensioners don't work for the same company for a long period of time. They're mobile and change jobs more frequently given things like the gig-economy.

-

Lack of flexibility in the current system. Pensioners should be allowed to make certain choices and possibly have access to their savings before the retirement age.

-

Double aging trend: the average age of people is getting higher and many in the pension space are wondering if they can still pay for benefits through premiums alone.

After attending an engaging keynote, we joined the crowd of attendees to participate in our first investment panel discussion. Titled "Rethinking Investment Portfolios," featuring a distinguished panel of experts including Sanjeev Gupta, Executive Director for Financial Services at Africa Finance Corporation, Joseph Cavatoni, Principal CEO Funds at World Gold Council, Geraldine Leegwater, Chief Investment Management and Executive Committee Member at PGGM, Bryan Lewis, V.P. CIO at US Steel, and Simon Pilcher, CEO at USSIM.

Panelists stressed that the pension industry is fundamental to economic prosperity and well-being around the world. However, pension plans also represent the aspirations and anxieties of future retirees in terms of how the pension is managed and the contributions that are received. Simon noted that his largest challenge is the more you know, the more you begin to realize that you don't know, and forecasting the future is difficult. An example was climate change and how pensions are trying to influence climate decisions by working with the companies they own and working with governments and regulators who set the landscape. Many are so focused on the quick wins around carbon emissions, where they are exporting the manufacturing of those carbon producing functions to other countries and then importing the final goods. This doesn't reduce carbon emissions holistically; it only treats those emissions as more of a shell game, moving it from one country to another.

Bryan Lewis, US Steel, added that pension governance is crucial and has to be prepared to weather market crashes, geopolitical conflicts, variable rate environments, fees, and more. In terms of dealing with regulators and driving change, standardization is key, especially when discussing ideas around sustainable investing. What might work in Pennsylvania may not make sense when compared to energy policies in Texas or California. Panelists agreed that when looking at portfolio construction and future themes, portfolios need to have an appropriate mix of risks around inflation hedging, real interest rate hedging, exposure to growth, and prospects of high returns of equities. Asset classes like private markets, debt, real estate, and infrastructure are not off the table for this panel of experts.

The Analyzation of Energy Transition

This next panel overlapped some familiar themes that Vidrio has heard recently through this event and others on energy transition.

We all know that energy transition has been a mega trend for a while and has especially accelerated over the last few years, (especially on my own trips to the Middle East where alternative energy projects are being discussed regularly - Google: Egypt solar farms exporting to Great Britain).

During the panel discussion, "Riding the Energy Transition" experts including, Antonio Miguel Ribeiro (Director, Enterprise Risk Management, Mubadala Investment Company), Petya Nikolova (Deputy CIO & Head of Infrastructure Investments, New York City Comptrollers Office), Lodewijk Meens (Senior Portfolio Manager, APG Asset Management), Ariel Ezrahi (Director of Climate Strategy, NewVest), all weighed in on how they look at funds; slicing and dicing to make a valuable allocation or strategic assessment for the future.

NYC State Controller, Petya Nikolova remarked on seeing a lot of specialized funds emerging across the market, while diversified managers are increasing their exposure to more energy transition strategies. Exposure in these types of strategies is moving north of 25% of the portfolio’s weight, and provides a good indication of how allocators are looking at renewables, battery storage, solar and more. The one strategic issue that the panel noted is, (due to the lack of an official track record) business models are harder to evaluate from a risk/return perspective and require a deeper dive into underlying investments.

Antonio, (Mubadala Investment Company), reiterated the lack of longer track record will make evaluations more difficult but not impossible. Critical steps that he outlined included:

-

Deeper understanding of the deal itself is critical. Be sure to excel at good due diligence and if you can develop an in-house expert that will aid in future investments.

-

Geopolitics need to be considered in any energy transition strategy, and similarly to what Simon Pilcher (CEO, USSIM) noted from the last panel, understand what you know and what still needs to be figured out in your energy transition outlook.

-

Metrics: what is the perceived risk, will banks lend to certain strategies above others and how do you measure performance?

-

Engage with GPs by promoting active oversight and encouraging the adoption of best practices. From here this strategy would cascade down to the underlying companies, (noted that this is an active strategy that Mubadala employs today).

Petya emphasized that the current expenditure on energy transition strategies amounts to approximately $1 trillion per year. However, in order to achieve success, asset owners must be willing to increase their investment to a range of $4 to $5 trillion per year by 2030. This is necessary to accommodate the growing demands for staffing, resources, risk management, and overall knowledge in the field.

The panel rounded up the discussion with a question into artificial intelligence and how it can be leveraged across energy transition and risk management. Overall, AI brings incredible analytical capabilities that can be applied to energy transition and data management. Here at Vidrio, we are leveraging AI and data management to assist pension CIOs and investment teams with greater risk monitoring, due diligence, and overall driving greater efficiency across investment operations.

What Happens at Retirement?

This panel discussion featured insights from Nikki Pirrello (President of World Pension Summit Chair, P&I) Arnoud Ringelberg (Manger of Operation, Heineken Pension Fund), Rory Murphy (Chairman of Board, Merchant Navy Officers Pension Fund), Eve Read (Senior Director of Strategic Delivery, Smart Pension). The panel opened with the recent challenges that pensions face with their members. Arnoud, (Heineken), and Rory (Merchant Navy Officers Pension), both agreed that more could be done in the way of proving clarity regarding the terms around pension plans. Information is key and those receiving the payouts will need to know the amounts not only 5 months or 5 weeks prior to retirement, but more like 5 years.

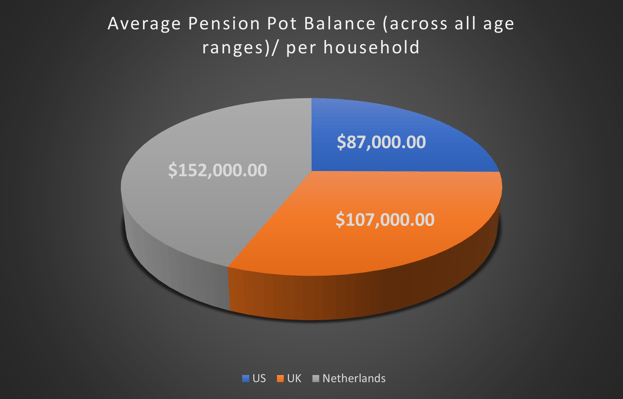

One major challenge prevalent in the UK is the lack of savings among individuals, resulting in the absence of any compounding interest benefits from these current savings. Recent statistics from the US, UK, and Netherlands indicate that people are simply under-saving, which is further showcased in the pie chart below:

In trying to change the course in the lack of communication, many panelists agreed that pensions need to communicate early and use the right channels to help employees make the right decisions. Heineken organizes a monthly webinar and is pushing for participation to grow beyond the 30%. Eve (Smart Pension) suggests trying to figure out where your members are when thinking about money and engage them directly in those areas. Don't be afraid of using lots of channels for communication. Eve continued that currently we're lucky to see 50% of members registered for an online account, versus the other 50% who have no idea how much money they have saved to date.

Rory highlighted that regulations often hinder effective communication strategies. He expressed concern that much of the pension jargon used is overly technical and fails to resonate with pension members. In particular, UK pension funds are prohibited from allocating funds for webinars aimed at their members because it is not considered an investment-related expense. However, in Holland, such restrictions do not exist, allowing for the utilization of educational webinars to their full potential.

Rebalancing Sovereign Wealth Funds

In our last panel of this event, we shifted gears from pensions to Sovereign Wealth Funds (SWFs), attending the "Rebalancing Lessons from Sovereign Wealth Funds", featuring Verena Kempe (Head of Investment Management, KENFO) Brian O’Connor (Senior Investment Director, Ireland Strategic Investment Fund), Victoria Barbary (Director of Strategy & Communication, IFSWF), Antonio Ribeiro (Director, Enterprise Risk Management, Mubadala Investment Company).

When institutional investors think of SWFs, many envision locations like Norway or the Middle East that bring in large national resources and turn that into renewable financial resources by investing across global financial markets. However, over the past 10 years there's been a genesis of SWF's that are coming out of non-natural resources, having a strong home bias for investing, (a blending of state-owned enterprises working for scale national and regional champions.

Ireland, is one prime example having a mandate that is pushing for a commercial return while impacting the local economy. They do this by investing in all sectors and categories while balancing cash in a separate liquidity portfolio.

KENFO, was the first SWF set up in Germany and has a focus on German utilities, keeping reserves aside for the decommissioning of nuclear power stations in the country. Decommissioning efforts were pushed through the German government following the Fukushima disaster in 2011.

Vidrio touched on the German nuclear perspective recently in the Thematic Investors podcast on uranium investing. You can catch that interview with Azarias Capital here, but it will be interesting to see if Germany re-evaluates their position in light of searching for new energy alternatives in battling climate change.

Mubadala is over 20 years old and is set up to diversify the economy of Abu-Dhabi and create wealth through sustainable returns. Even though they're situated in an oil rich region this SWF with ~$380 billion in AUM, invests in semiconductors, energy, renewables, agriculture, and mobility. They continue to invest based on history and predicting what will happen in the future.

All the sovereign wealth funds (SWFs) unanimously shared the belief that the institutional markets are undergoing significant shifts, leading to increased uncertainty. This has raised several question marks that need to be addressed, including:

- Demographics and societal change: what people value, what people want to buy and assign value to, and what companies will drive their value from today.

- Technology: how much disruption will come from the ChatGTPs and other deeper learning AI subsets, and the opportunities that will exist.

- Climate risk and ESG: what are some of the best strategies today for integrating into your investments.

- China: how do larger institutional investors play the game with the region. (Vidrio recently spoke with Chris Ailman of CalSTRS - see what he thought of China, and if he's considering them a friend or foe).

Staffing Up for SWFs

The discussion swiftly shifted towards future prospects and the strategies sovereign wealth funds (SWFs) can employ to attract talented individuals from the next generation who will contribute to the ongoing investment endeavors.

Verena (KENFO) admitted that dealing with wages and retaining people is a struggle. When hiring they try to look beyond just the investment/portfolio side of the business but also identify gaps in risk management, operations, investment operations and finance. There is definitely a balance to analyzing prime internal capabilities and what can be outsourced.

Brian (Ireland Strategic Investment Fund) stated that they're working on diversity and evolving who they hire and at what stage in their career. Traditionally they hire at the early stage to mid stage of their career, develop the talent in-house through an investor development program, and then they have a bench of 3-5 year employees that can drive better performance. They're also starting to target individual teams with varying skill sets and personality types.

Antonio (Mubadala) said HR hiring needs for SWFs are needed but being conscious about how it impacts your investment strategy and how active you want to be with investments matters. In their hiring, they've noticed that investment candidates don't deal well with ambiguity, which sadly is required when big structural changes are present in the market, like the current geopolitical issues that we're seeing today. Antonio says he always likes to brainstorm solutions especially since geopolitics is having a significant impact on investment outcomes. In terms of training, having a global risk team as well as service providers that can help understand geopolitics fluctuations is critical. Here at Vidrio, our platform is configured to stress test each institutional portfolio as well as each investment using historical scenarios and single factor shocks. In addition to our standard scenarios, Vidrio works with our clients to add additional scenarios and factor shocks that will provide a comprehensive picture on how investment cases will respond. In closing out the session, Antonio also said that other SWFs should look at AI as a disruptor that can be a source of incredible productivity gains.

Our experience at the World Pension Summit was truly memorable. Not only did we gain valuable insights and expertise from the panel discussions, but we also had the opportunity to network and connect with leaders from different pension plans. It was enlightening to discuss the challenges they face in navigating these markets. If you're interested in learning more about Vidrio Financial, we encourage you to reach out to us. Discover how we can seamlessly integrate with your investment teams, providing superior data collection, risk management, portfolio monitoring, and much more.