In Vidrio's latest blog, we recap highlights and sessions from the Clear Path Analysis Private Markets Investor event, where institutional players focus on alternative investing for greater rewards and portfolio diversification amid uncertainty in private markets, Solvency II, and private equity.

By: Nick Bourne, Commercial Director, EMEA, Vidrio Financial

European investors are currently grappling with a myriad of uncertainties as they strategically allocate their investments to address:

- Economic concerns – zero growth and whether the UK economy is in a mild recession.- Political climates – possible change to the UK government in late 2024. The ongoing war between Ukraine and Russia.

- Regulatory challenges – Solvency II is still being tweaked, but any new rules could impact any money on the sidelines.

- Liquidity mismatches – allocators are demanding access to private markets with greater liquidity.

Vidrio Financial attended the Clear Path Analysis Private Markets Investor Europe event last month to dive into these concerns and learn how institutional investors are working to address them while innovating investment operations. Read on for a recap of our takeaways from this great event.

Policy Approaches, Private Markets, and Pension Returns

The event kicked off with the opening address titled: Exploring policy approaches to tackle low UK productivity, stimulate private market, and improve pension returns, with Nicholas Lyons, Lord Mayor of the City of London, and Chairman, Phoenix Group. Nicholas mentioned that UK state pensions are unfunded and capital markets can’t support growth companies due to a lack of demand, investment, and skills. Furthermore, defined benefit (DB) pensions are closed and underperforming by ~1.7% per year. In his opinion, this needs to change starting with a greater focus on alternatives. Nicholas pointed to an average of UK pension funds being invested in ~9% alternatives compared to a global average of 23%.

Unlisted equity is currently at 1%, which Nicholas would like to see rise to 5% for these funds. Unlisted equities or securities are usually issued by smaller firms that wish to avoid the requirements of an official exchange.

Typically, this type of asset is less liquid than public securities, and the transparency of these investments can be a major concern for institutional investors. Championing greater transparency in institutional investing has been a huge differentiator and benefit for those who become a part of the Vidrio community. Vidrio participated in the Clear Path event last year, where discussions surrounding transparency and its impact on allocators were prevalent. Our detailed analysis of that insightful conversation can be found in our earlier blog here.

Pension Innovations, Illiquid Opportunities, and Operational Hurdles

The next panel that we attended was focused on the advent of pension innovations – CDCs, LTAFs, and pension consolidators – and insurance solvency reforms: What is the opportunity and outlook for greater investment in illiquid assets, and what are the operational hurdles?

This panel was moderated by Andrew Putwain, Editor and Community Manager, Clear Path Analysis, and featured insight from Mike Chappell, Co-Head of Private Markets, Phoenix Group, Stephen Tiley, Pension Funds Manager, Trustee Director, WHSmith, Bob Tyley, Head of Credit Risk, Hymans Robertson, and James Monk, Investment Director, Fidelity International.

The panel discussion began with a focus on Solvency II regulations, exploring how these new rules will impact insurers' ability to invest in long-term institutional assets. For those unfamiliar, Solvency II is a comprehensive framework replacing its predecessor, Solvency I, designed to enhance transparency, competitiveness, and comparability for insurance firms operating within the EU.

Solvency II is structured around three key pillars that address the following aspects:

- Pillar 1 – Quantitative requirements: valuing assets and liabilities to calculate capital requirements.- Pillar 2 – Risk management and governance. In this pillar, a supervisory process is outlined with auditors to ensure the regulatory framework is combined with a competent risk management system. Helps to inform larger business decisions.

- Pillar 3 – Transparency. Full disclosures to supervisory authorities and public disclosures. This ensures market discipline, increasing comparability and leading to more competition.

(You can view more Solvency II details here).

The perspective is that Solvency II will have numerous benefits for allocators, including the creation of new market opportunities, an increase in capital inflows into private markets (i.e., private debt), and a reduction in risk levels across the board.

From a Vidrio perspective, we’re already seeing many allocators move their allocation strategies towards the private credit market (the market is close to $1.5 trillion), either through direct investment or co-investment. Many at the event believe the demand for private market assets is rising, with pension funds, insurance companies, and even “retail” investors all looking to go deeper into private market investments. Panelists agreed that the uncertainty around solvency II is stopping some allocators from making moves that their portfolios desperately need. Looking down the road, many see the rules around Solvency II being further tweaked as opposed to being rewritten; however, that equates to more uncertainty in the minds of this panel as investment opportunities are being missed.

Long-term asset funds (LTAFs) have been championed by regulators in recent years, but they create issues for DC schemes, especially where allocators are obsessed with transparency and costs for these investments. There’s also the liquidity argument, as these assets in the context of a DC fund have very little liquidity and will work against people who are pulling money out of these schemes.

Operations, Risk, and Reporting Forum

We quickly moved from our discussion of Solvency II to Sahem Gulati, Head of Strategy & Consulting, M&G Plc, and his views titled: Linking transformation with the target operating model aims: Setting resource allocations, internal and external partner objectives, and time frames to achieve intended outcomes.

During this discussion, similar themes that Vidrio has heard discussed around the business were covered. Sahem began the discussion from the perspective of asset managers, turning their attention to private market allocations driven by a range of compelling factors, which include:

- Higher fees.

- The ability to lock in clients for longer periods with a vehicle that has a long-term investment horizon.

- Greater portfolio diversification.

- New investment options like LTAFs.

- Greater inputs for stakeholders into sustainability.

The challenge at hand is that asset managers continue to heavily depend on spreadsheets, while investors are increasingly pushing for more stringent reporting standards and greater transparency. Sahem believes that this rising degree of portfolio complexity means that managers will have to choose between either adding headcount or growing their investments in technology.

Unfortunately, in an industry where there is now a skill shortage, expanding staff isn't always easy. When you combine the severe data problems with the lack of talent, many people will be prevented from implementing a transformation strategy that will increase investment returns.

Sahem did recommend a few tips in managing a technology transformation to assist in improving alpha, beginning with:

- Strong cultural buy-in.

- Transparent prioritization.

- Correct execution team.

- Set the right expectations early.

- Continuing to show the value of change and you move forward.

We encourage you to have a listen on this podcast as it parallels many of the same points that we heard from Sahem. Additionaly, Vidrio has launched an AI allocator survey to collect allocator opinions for the future of artificial intelligence and machine learning in their investment operations. You can click on the picture below to take the survey which only requires 2-3 mins of your time but will help Vidrio out immensely as we bring more AI-powered solutions to allocators in the future.

(Take the Vidrio AI Survey Today).

(Take the Vidrio AI Survey Today).

Remaining Competitive in Private Equity

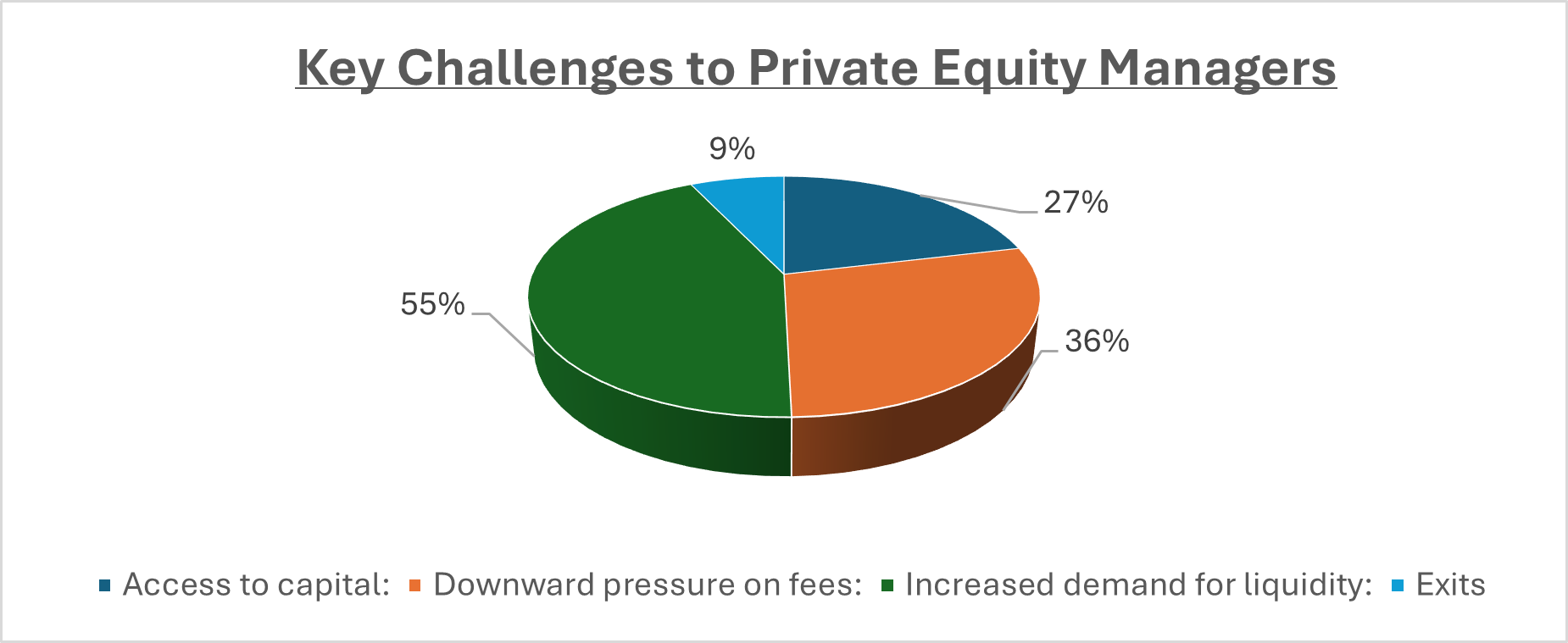

The final presentation that we attended featured Nick Dashfield, Head of Strategic Projects, Globacap for the session titled: What are the challenges to remaining competitive in private equity in 2024? How can digitization help mitigate those challenges? Nick listed the main issues that private equity managers are currently facing while highlighting some of the most pressing issues facing them.

Nick went on to add that the adoption of technology solutions to aid in investor operations has traditionally favored US managers, however, the willingness of European firms looking to improve their technology stack is growing especially given increasing demand from the investor side. However, as Sahem mentioned in the early panel there is a clear lack of internal technology knowledge for these private equity shops. As such they are beginning to look outwardly to the hiring of CTOs and other development teams to expand their knowledge.

Vidrio had a terrific experience at the Clear Path Analysis event, taking advantage of the thought leaders in the industry, private market insights, and premium networking opportunities.