Want to know where the Middle East is headed in terms of institutional investments and how alternatives play in the space? We recap the Markets Group Private Wealth Middle East Forum and overlay Vidrio innovation for your investments teams.

By: Hattan Jabban, Business Development Executive, Vidrio Financial

In recent months Vidrio Financial has been navigating the globe to bring you some of the best insights from leading events and the industry titans that attend these conferences and forums. The Markets Group – Private Wealth Middle East Forum, was an event that featured insights from family offices, high net worth wealth managers, and private banks from across the Middle East. Below are a few of the Vidrio takeaways from this event.

Maneuvering the Macro

The first panel that we attended was Maneuvering the Macro featuring insights from: Karine Kheirallah, Director, Investment Advisory, Liechtensteinische Landesbank AG, Georgios Leontaris, Chief Investment Officer, Europe, Middle East and Africa, HSBC Private,Banking and Wealth, Manpreet Gill, Chief Investment Officer, Africa, Middle East and Europe, Standard Chartered, Haitham Juma, Head of Investment Solutions, Bank of Fujairah, Sandeep Jadwani, Head of Investments, Habib Investment Limited, Prashant Tandon, Chief Executive and Managing Director, Lighthouse Canton.

Source: Markets Group - Private Wealth Middle East Forum

Panelists began by covering the current situations facing investors in terms of volatility, rising interest rates, and the stress on the U.S. banking system. They agreed that a further slowdown in the US GDP could occur as the economy is stomaching a lot of volatility now, and the pace of tightening has yet to hit the market. A recession was a concern among attendees with an expected timeline of ~12 months. Compared to Europe, despite a slowdown in growth and high inflation, panelists felt that Europe is reactive to what the U.S. does, which equals a drive to do it better and avoid similar mistakes, like the recent U.S. banking crisis. European markets have shown some resilience to these crisis’s leading many to believe that by including Europe in a portfolio, you insert a key factor to avoid higher risks.

The focus shifted to the macro backdrop on China and what that would mean not only for regional allocators, but portfolios that have exposure to the Chinese market. Surprisingly, Chinese economic data is on the uptick with indices looking strong.

- Retail sales were up 10%

- High-end manufacturing is increasing by double digits.

- Earnings and valuations look hopeful.

However, despite these positive signs, the Chinese market is very opaque and has little to no transparency when it comes to institutional investing signals. As Vidrio has reported on in the past, allocator transparency is something that should be harvested across international markets. On where to invest, panelists had the following advice from this session:

- Be sure to look at investments past the 5-year mark, don’t chase short term trends, as the markets are at least 6-12 months ahead of the economy.

- Asset classes showing promise include alternatives and fixed income, but ensuring diversification is still key across cross-asset and geographical regions.

- Avoid panic selling at all costs and work in high quality investment grade bonds (highest yields in 15 years).

Private Market Access and Approach

The value of attending multiple events throughout the year, and being available to allocator clients globally, allows us to hear similar themes regardless of the region. Earlier in the year, we put some keystrokes to our blog around the death of the 60/40 portfolio and how private markets should be picking up steam as we move into the rest of the year, (read more on that here).

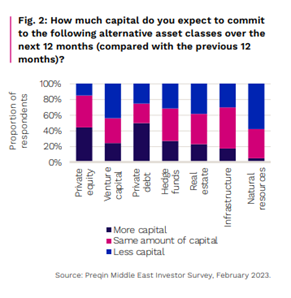

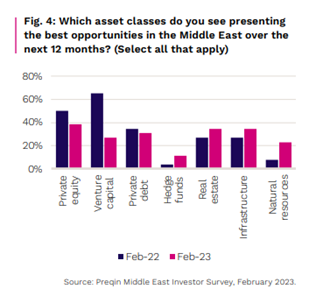

In March, Preqin released their 2023 factsheet for Middle East Investors showcasing how some of the alternative asset classes will be approached moving forward into 2023. We thought it might be a good idea to quickly revisit these to see if these responses matched well against our own takeaways from the private market panels below. We will let you be the judge:

Accessing the Best of Private Markets featured strategic insight from Safa Bouzidi-Leterme, Head of Digital Wealth Management—Investment and Insurance, Al, Hilal Bank, Michael Elio, Partner, StepStone Group, Marco Bizzozero, Head of International & Member of the Executive Committee, iCapital, Mark Bickerstaffe, Managing Director, Hayfin Capital Management. The panelists agreed that the world is different today, than when the 60/40 portfolio split was first envisioned. Private markets have grown from $1 trillion to $30 trillion, and allow for significant value creation across institutional investors.

Vidrio is energized to hear how technology is making private markets more accessible to investors while navigating the concerns investors typically voice in this asset class. Frequent concerns typically involve unstructured or inconsistent data, high degree of reporting errors without a true source of data integrity, and a loss of control due to lack of bandwidth from the investment teams. Through Vidrio’s latest enhancements, private market investors can run performance (Time Weighted Return, IRR, MIRR, Contribution to Return), Exposure and Risk (Holdings Data Enrichment), and Cash Flow Analytics (IRR, MIRR, Investment Multiple, Realization Multiple, Unrealized Multiple, Realization Ration, PIC Multiple) across one comprehensive platform.

Regionally, panelists agreed that the U.S. private market was massive and that there’s no Bloomberg terminal helping you research who oversees these private market management teams. The panelists recommended that any successful private market strategy needed to have physical teams on the ground with a basic understanding of the culture and their way of doing business in the given region. Currently, opportunities are not that abundant in the Middle East and the ones that do appear on the radar, are consistently going to the likes of BlackRock or KKR.

In a later roundtable discussion, Democratizing Private Markets, many realized that this was not an easy asset class to be involved in and it was even more critical to have the right data points to track cash flow and more.

GP led deals exploded in 2020 and have no signs of slowing down today. Roundtable participants agreed that:

- IT & Healthcare = 50% of the P.E. Market

- IT & Energy is underweight while Healthcare and Industrials may be overweight.

- Start focusing on the developed world as they are stable and have stronger balance sheets.

- Europe presents an opportunistic play for private market investment while the rest of the world has geopolitical and FX risks.

- Focus on small and mid-level companies.

Overall, the private market environment is still attractive, and while leverage is coming down and pricing is going up, deals that are getting done and still outperforming their public market counterparts.

Family Offices and the ‘VFRE’ Initiative

Family office intelligence was nicely spread out across the event. Unfortunately, we still hear that Excel is the most widely used tool today for wealth managers. Here at Vidrio this runs a bit counter-intuitive to our own beliefs, and we have voiced our concerns over this dangerous approach. You can read more on the use of Excel and our perspective from another event, but we believe that it might be time to spin-off from the NZAM initiative, creating the VFREI (Vidrio Financial Reduction of Excel Initiative) for allocators. Note, we’re still working on the name.

All kidding aside, we realize that Excel isn’t going away, however it’s usage can be streamlined through a single technology enabled service platform like Vidrio to help improve governance, the ability to run multi-asset class portfolios, improve data transparency, exposure scenarios, and normalize reporting and data analytics. We learned through our time at this event, that family offices across the Middle East are investing more in alternatives and require predictive pricing tools for these investments, complete with commitments and drawdowns, pdf scrapping and more.

Admittedly, data aggregation is a huge problem and extremely complicated for family offices that invest in more unconventional items like wine, planes, boats, art, and jewelry. Given these types of alternatives, many family office investment teams are researching ways to optimize their own bandwidth through Artificial Intelligence. The Vidrio Blog recently covered generative AI, and how our system helps allocators by streamlining business functions without giving up the human element. It simply becomes an extension of the investment team, allowing family offices, sovereign wealth funds, endowments, foundations, OCIOs, and asset managers to refocus their efforts on the strategic ends of their investments and less on the back-office operations. When it comes to family offices in the Middle East, the sophistication of the data needs to be fed into a single place for quick and efficient analysis, and in the current environment there is clearly a lack of those processes. However, positive trends are emerging and should help wealth preservation and more in the future.

Real Estate Outlook

Institutional investing is incomplete without a discussion on the real estate market, especially when it’s so highly tied into the culture of the Middle East. The Outlook on Real Estate panel featured insight from Bharat Pratap, Managing Director, LGT Private Bank, Mohamad Abouchalbak, Chief Executive Officer, SFO Capital Partners, and Drew Bowie, Managing Director, MA Financial (formerly Moelis Australia). The panel kicked things off with a look at the type of assets and performance and where value opportunities are closely measured with a bit of risk taking. Real estate credit has the most attractive IRR for at least the next 18 months, but many are looking at smaller deals as many valuations are backward looking. They noted the volatility and uncertainty in the markets but when it comes to alpha generation, they noted that investors will need to take more risks and have more involvement than before to capture the right returns.

Technology in real estate is also playing a major role with regards to portfolio management and analytics reporting all the way down to bringing construction costs down. There’s a lot of waste in construction and technology is trying to create a more efficient process to manage that material waste as well as leverage the data around mortgages to help make better and faster decisions on future investments.

Overall, our time in Dubai was too short and we learned so much and have a lot to look forward to as the region continues to innovate building a legacy in wealth preservation. For the region, the belief is wealth is tied to health. Here at Vidrio we would evolve that statement for ‘wealth health’ tying it into:

- The health of your family.

- The health of your data.

- The health of your investments and asset allocation.

- The health of your technology.

We hope you enjoyed our takeaways from the Markets Group – Private Wealth Middle East Forum from Shangri-la, Dubai. If you would like to learn more about how Vidrio Financial is partnering with family offices, sovereign wealth funds, foundations, endowments, asset managers, OCIOs and more, then please reach out at your earliest convenience.