Covid-19 and a crash in the oil markets have triggered a bear market that may lead to a recession. While the complexion of this bear market is different from 2008-9, there are applicable lessons from the last recession that can be helpful to Allocators in 2020.

Vidrio prides itself on being “By investors, for investors” because much of our senior staff previously worked on allocation teams. We are sharing some of the lessons we learned managing allocated portfolios during the great recession of 2008-9. While some points may seem like common sense, we hope you learn additional ideas to help you navigate turbulent markets, or at least serve as a reminder as to what worked well in the past.

Short Term Concerns

The golden triangle of communications: Funds > Staff > Clients

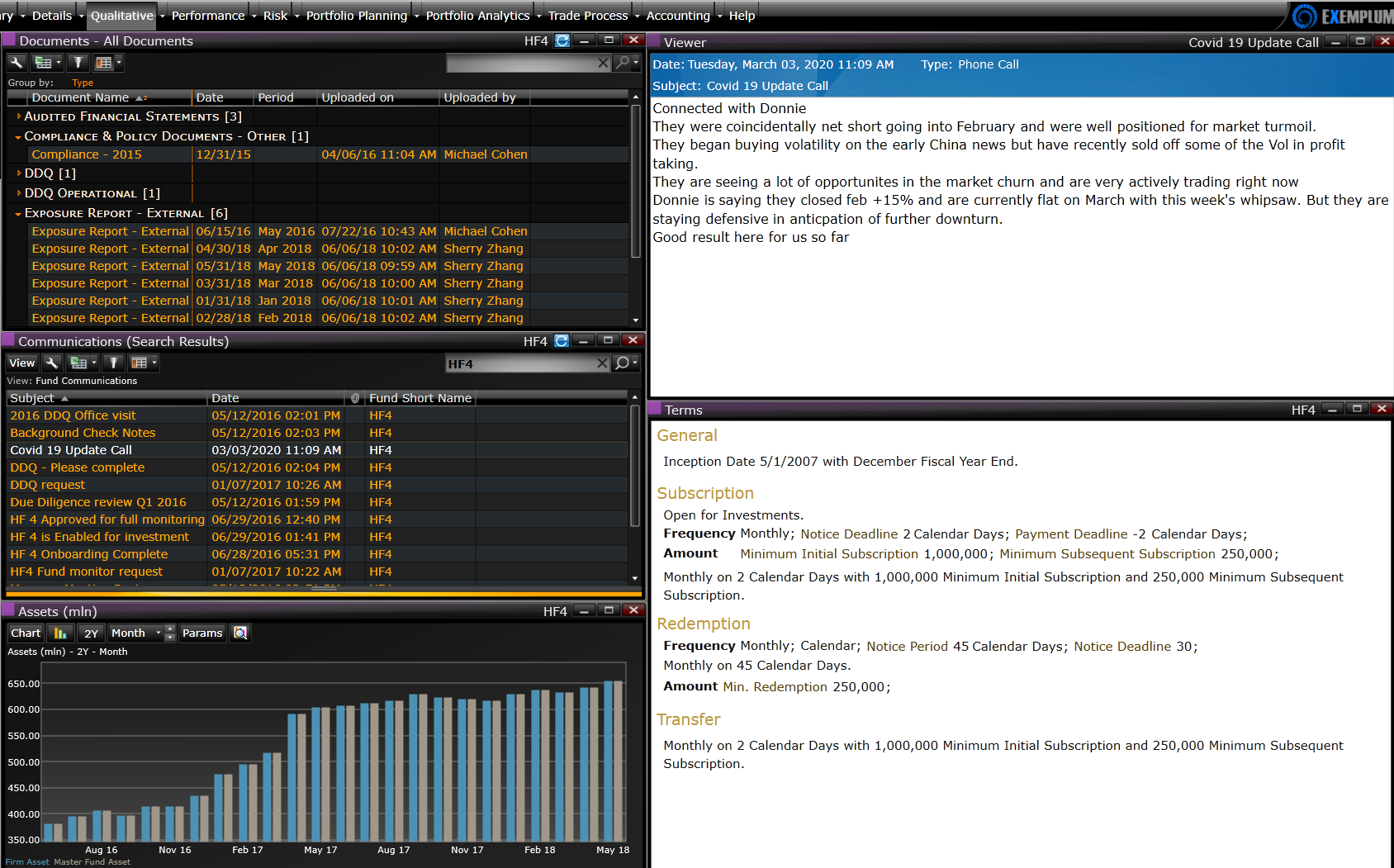

Funds. Allocators need to walk a fine line with their external managers – on the one hand, you need to let them focus on navigating the current market; on the other, you need updates. The critical updates you need are performance, exposure, AUM, and positioning plans. From these key data points, you can look to more in-depth analytics, as outlined below.

Staff. While a portfolio manager may know his/her portfolio inside and out, the rest of the team relies on systems and communications to stay informed. Make sure your information is flowing through systems, and that your communication channels are wide open and active.

Clients. Make sure you are giving your investors and key stakeholders the level of communication, comfort, and support you want from the funds you invest in, if not more.

BEST PRACTICES - Manager Monitoring

- Performance – This cornerstone item feeds a lot of downstream analytic needs.

- In addition to informing the portfolio performance you will communicate to your stakeholders, it powers many risk models, comparative analytic statistics, and is the trigger for determining if you need to probe the manager more deeply.

- If the number is really bad, you’ll need to spend some more time on the phone. Good performance can lead to a quick conversation.

- Exposure – Gross/Net/Long/Short is the basic.

- Deeper exposure analysis, ideally gleaned from manager holdings reports, or harvested from manager reports can provide advance guidance on how the portfolio will perform, what areas of the portfolio might be under stress, where hedging opportunities might be needed, and how to position for market recovery.

Watch Video

- Deeper exposure analysis, ideally gleaned from manager holdings reports, or harvested from manager reports can provide advance guidance on how the portfolio will perform, what areas of the portfolio might be under stress, where hedging opportunities might be needed, and how to position for market recovery.

- AUM – Critical for a couple of reasons:

- You want to compare the AUM drawdown to performance. If AUM is dropping more than the loss due to results, it means the manager is redeeming money to other investors. This is fine to a degree but should be a concern if AUM is dropping precipitously

- A fund doesn’t actually go out of business because of performance. It dies when it can’t pay its employees anymore. It is good practice to build a model that determines the minimum AUM a fund needs to stay afloat. This model should multiply salary estimates by staff numbers, rent, systems costs, etc. and compare against management fees from AUM. By knowing this break-even point, you can assess when a manager is facing a business risk

- Scenarios and Stress Testing

- In addition to VaR analysis, It is crucial to run a risk analysis that includes scenario and stress testing. Stress and Scenario tests can forecast future drawdowns and consider options for portfolio changes and hedges.

- If the only input you have to power these analytics is performance, be sure to add the most recent performance to this risk model.

- Think about it this way – if you receive monthly performance from a manager with a 5-year track record, you are loading 60 data points to a risk model for regression analysis. If you improve that to weekly performance, its 260 data points, daily are 1,100. Obviously, more data makes for a more viable model. If you can perform holdings based analysis, there are millions of data points powering your review, and you can fulfill various decompositions across exposure categories.

- In all cases, it is essential to do the best with the data you have, but recognize the limits of models with small sample sizes.

Watch Video

Mid Term Considerations

You may want to make portfolio changes, or you may be forced to make changes. To prepare for either case, consider the following:

- Liquidity Analysis

- At the portfolio level, it is vital to assess and reassess which managers offer you potential near time liquidity if needed. Which managers are locked or gated, and what the redemption terms are – notice period, dealing date, holdbacks, etc

- It is equally important to assess the underlying liquidity of manager holdings. This ranges from illiquid in the case of private investing, to (hopefully) fully liquid holdings such as public equities. Even in public equities, certain classes such as micro caps and emerging markets may become illiquid or trade very wide. Other items like off the run debt/credit instruments, deem OTM/ITM options, and certain swaps may become illiquid or difficult to value.

- Matching these two concepts is critical. If you do are in a lock-up period with a manager, and other investors are not in lock-up but are redeeming, the manager will trade his/her most liquid holdings first ro meet fund redemption demands. This leaves remaining managers holding the dregs of the portfolio, which will be difficult to value or exit if forced selling becomes necessary.

Watch Video - Market Disruptions – How you can take advantage

- In all likelihood, your portfolio is what it is during this crisis—allocating to external managers like steering a battleship, not a speed boat so you can't make quick changes to a portfolio of external manager allocations. Hopefully, your managers you put your trust in are doing well for you.

- But, now IS the time to think about positioning for a recovery. Are there strategies that can really capture upside best when it happens? Were there managers in the portfolio that were only there for downside protection, if that event has happened, is it time to rotate to more beta capturing strategies?

- Keep an extra close eye on competitors. If you are outperforming, lean into your success to raise assets when markets stabilize. If you are underperforming, double down on your client servicing.

Long Term Considerations

After the event, you should continue to analyze the following:

- What worked, what did not? Was your investment thesis solid? How was your team’s crisis decision making? Did managers perform in line with expectations?

- Did your Business Continuity Plan work? Were you able to keep running remotely?

- Did your systems hold up? Were there outages?

- What did you learn?

Entering a bear market can be an uncertain and traumatic time. But remembering that investing is a practice of strategically reacting to cycles, a bear market can also be a time for recalibrating your funds to be well positioned for future gains.

Contributing Authors:

Mazen Jabban

Chairman & CEO

Mazen founded Vidrio Financial in 2011 and is responsible for setting strategic direction and the firm’s product development roadmap.

Gygmy Gonnot

Managing Director

Gygmy joined in 2011 and heads the Vidrio Research team responsible for monitoring the complete lifecycle of information on all funds on the Vidrio Platform, encompassing hedge fund performance measurement and document management, terms and corporate actions, exposure and attribution aggregation, plus liquidity risk monitoring.